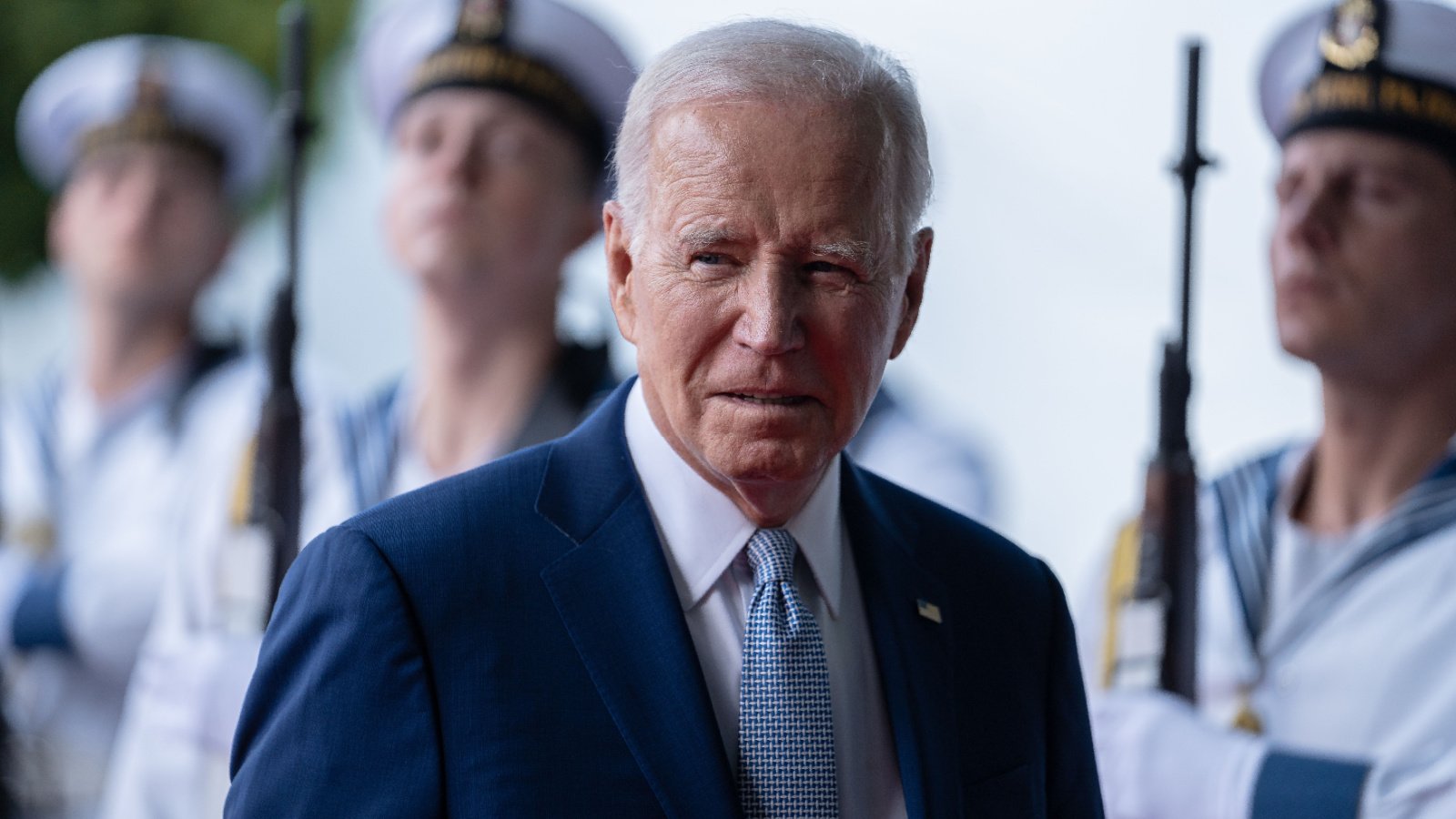

President Joe Biden introduced an enhanced initiative on Monday in line with his campaign promise to provide relief to over 30 million student loan borrowers. Biden’s comprehensive forgiveness plan outlines a strategy to substantially reduce the financial burden on a significant portion of the American populace, offering a new path forward for those encumbered by educational debt.

Specifics of Who Qualifies for Forgiveness

The latest proposals aim at offering financial relief to specific borrower groups, including individuals whose outstanding loan balance has surpassed the original amount borrowed due to accrued interest, and borrowers eligible for existing student loan forgiveness programs who haven’t yet submitted an application.

Additionally, those covered will include borrowers who began repaying their loans at least two decades ago, borrowers who participated in programs that provided minimal financial return,, and finally, borrowers facing financial difficulties.

Timeline For Latest Round of Forgiveness

These recently proposed changes are now entering a period for public feedback. Following this phase, the Department of Education will consider the input received and issue a definitive version of the regulation. Generally, a final rule established through the negotiated rulemaking process by November 1 in a calendar year can be implemented starting the following July.

A Relief Strategy for All Borrowers

The plan proposed by the Biden administration encompasses a sweeping cancellation of up to $20,000 in accrued interest for every borrower, irrespective of their income level. This gesture extends a financial lifeline to countless individuals struggling under the weight of their educational loans.

Targeted Forgiveness for Low- and Middle-Income Earners

A key feature of the new strategy is the full forgiveness of outstanding interest for borrowers in low- and middle-income groups who are engaged in income-driven repayment plans. This move is aimed at providing the most significant relief to those who need it most, ensuring a fairer approach to loan forgiveness.

Overcoming Opposition to Provide Relief

The White House statement highlighted the administration’s determination to overcome Republican opposition, which has attempted to thwart efforts to cancel student debt. President Biden has been vocal about his commitment to utilizing every tool at his disposal to expedite the cancellation process for as many borrowers as possible.

Navigating Judicial Challenges

Following the Supreme Court’s decision last June, which invalidated an earlier loan forgiveness proposal, the Biden administration has been seeking alternative routes to deliver on its promise of debt relief. This latest proposal marks an innovative approach to bypassing judicial roadblocks and delivering much-needed financial relief.

Past Efforts and Legal Challenges

The administration’s prior attempts at student loan forgiveness included the approval of $1.2 billion in loan cancellations under the SAVE Plan. However, this move faced legal challenges from several Republican-led states, demonstrating the contentious nature of the loan forgiveness debate.

Broad Impact and Immediate Relief

According to CNN, the Biden administration’s new plan could see millions of Americans experiencing debt relief as early as this fall. This initiative, still under development, reflects Biden’s efforts to continue finding new paths to loan forgiveness as his policies continue to face challenges from Republicans at the national and state levels.

Addressing the Cost of Higher Education

In a recent speech, President Biden underscored the prohibitive cost of college education and its repercussions on American society. He emphasized the need for action to alleviate the financial burdens that hinder individuals’ life choices and economic contributions.

Expansive Benefits of the New Proposals

The proposed measures are designed to offer relief or complete loan cancellation to nearly 70% of all federal student loan borrowers.

Criteria for Relief

The plan delineates specific criteria for eligibility, targeting borrowers who have seen their loan balances increase due to interest, those eligible under existing forgiveness programs, individuals who began repayments two decades ago, and those enrolled in low-value programs or experiencing financial hardship.

Public Involvement and Finalization Process

Before becoming official, the new proposals will undergo a public comment period, allowing for community input and adjustments based on feedback. This process ensures that the final plan reflects the needs and concerns of the broader public.

Potential for Early Implementation

The Department of Education has the flexibility to implement parts of the rule early. This could mean immediate relief for qualifying borrowers, particularly the more than 25 million who have seen their debt increase due to interest.

Record-breaking Debt Cancellation

Despite challenges, the Biden administration has canceled more student loan debt than any previous administration, focusing on public-sector workers, disabled borrowers, and those defrauded by for-profit colleges.

Student Loan Debt by the Numbers

According to educationdata.org, 43.2 million borrowers have federal student loan debt. On average, the outstanding federal loan debt balance is $37,088. The total outstanding federal loan balance is $1.602 trillion, which accounts for 92.8 percent of all student loan debt.