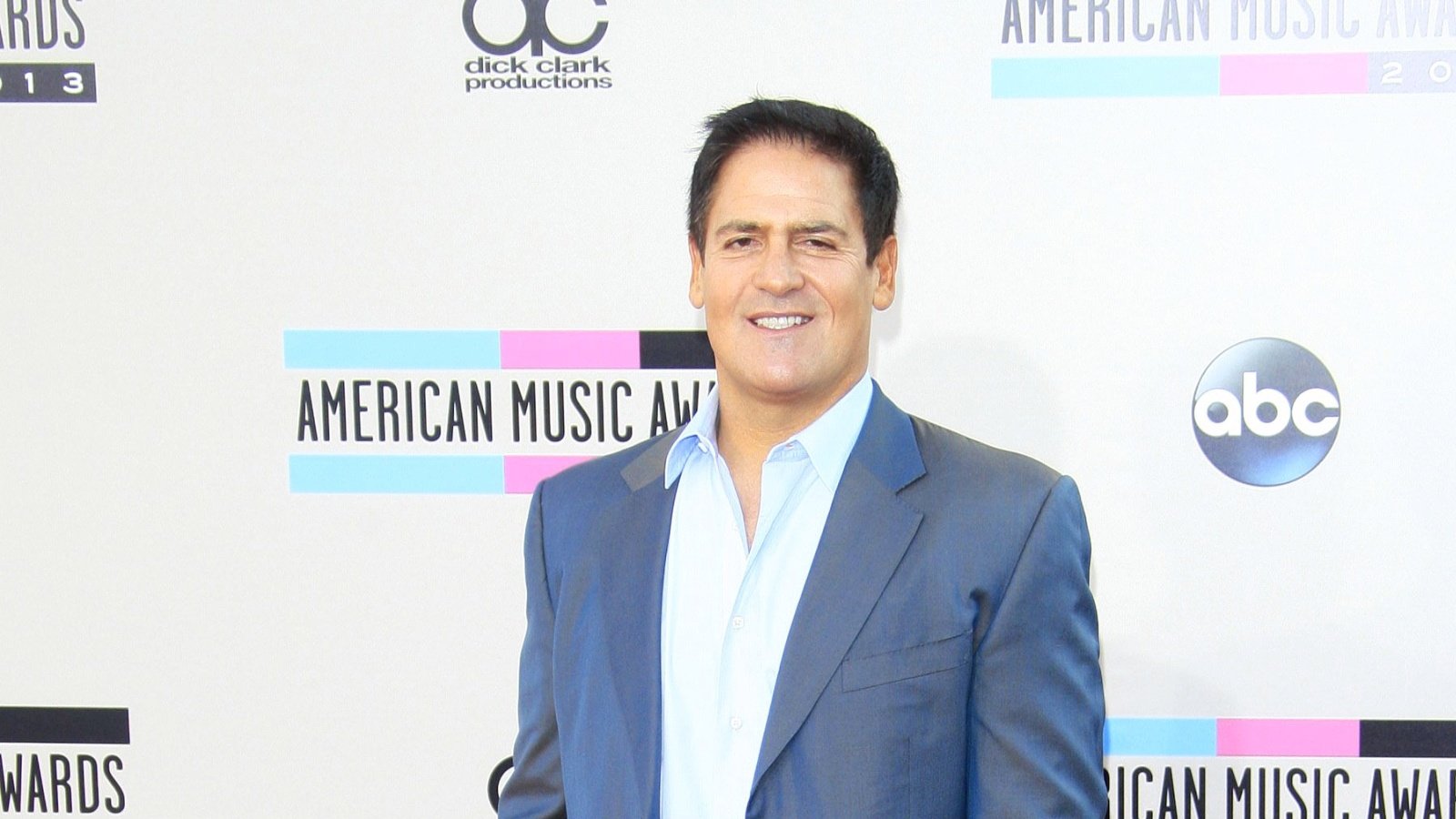

Accruing wealth is a skill that requires strategic planning, disciplined saving, and smart investing—areas in which Mark Cuban, a self-made billionaire and esteemed investor, truly excels.

By leveraging savvy investment strategies and an unwavering entrepreneurial spirit, Cuban has crafted a roadmap from his years of trial, error, and triumph. His experiences offer a clear path to financial success.

Here are his most actionable pieces of advice, providing you with the tools necessary for substantial financial growth.

Start Early

Mark Cuban emphasizes the value of starting your wealth-building journey as early as possible. He argues that the sooner you begin, the more time your investments have to grow. This approach leverages the power of compound interest, maximizing potential returns over time.

Learn to Save

Cuban recommends saving at least 10% of every paycheck before spending on necessities or luxuries. This habit not only cushions against financial emergencies but also builds a capital reserve for future investments.

Dodge Debt

Cuban advises avoiding debt, especially high-interest consumer debt, which he considers a wealth killer. He points out that the interest you pay on debts like credit cards can severely diminish your financial growth. Staying debt-free allows more of your money to be directed toward investments.

Invest in Stocks

Stock investments are a staple in Cuban’s wealth-building strategy. He advocates for investing in index funds that track the market, which historically return about 7-10% annually. Cuban’s approach minimizes risk while allowing for steady growth.

Start a Side Hustle

Cuban champions the idea of side hustles to generate extra income. He suggests choosing something you are passionate about, which ensures you stay motivated. This extra revenue can then be funneled into savings or investments, accelerating your wealth growth.

Read Daily

Cuban suggests reading about industries you’re interested in to stay ahead of trends and opportunities. This knowledge empowers you to make informed decisions and sparks innovative ideas for wealth creation.

Network Effectively

The billionaire stresses building relationships with people smarter than you as a way to learn and open up new investment opportunities. These connections can be invaluable, providing insights and advice that can lead to profitable ventures.

Live Below Your Means

Cuban lives more modestly than one might expect from a billionaire. He advises spending less than you earn, regardless of your income level. This discipline in personal finance ensures you have more money to invest and grow.

Take Calculated Risks

Taking risks is essential for significant financial gains, argues Cuban. However, he stresses that these risks should be calculated and not reckless. Research and thorough analysis should precede any major investment to mitigate potential losses.

Diversify Investments

Diversification is a key strategy that Cuban uses to protect his wealth. By spreading investments across different assets, you reduce the risk of catastrophic losses. This method ensures some parts of your portfolio can thrive even if others falter.

Master the Art of Selling

Whether you’re selling a product, a service, or pitching an idea to investors, effective communication can significantly increase your success rate. This skill ensures you capitalize on the value you create.

Focus on High-Return Investments

Cuban looks for opportunities where technology disrupts traditional business models, often resulting in exponential growth. These investments, though potentially riskier, offer the possibility of remarkable returns.

Stay Informed About Trends

Understanding economic trends is crucial, Cuban believes. He keeps a close eye on global economic indicators that could affect his investments. This foresight allows him to adjust his strategies proactively, safeguarding his portfolio.

Develop Financial Literacy

Financial literacy is a must, according to Cuban. He suggests taking courses or reading books on finance and investing. This education helps you understand complex financial instruments and make smarter investment choices.

Embrace Failure

Cuban encourages embracing your failures, learning from them, and using the experience to improve. This resilience ensures that setbacks do not deter your path to wealth accumulation.

Innovate Constantly

Cuban urges would-be entrepreneurs to innovate continuously, as staying ahead in technology or business practices can lead to substantial wealth. Innovation attracts investment and drives business growth.

Prioritize Value Creation

Value creation is crucial for sustainable wealth, according to Cuban. He focuses on businesses and investments that offer real value to consumers and society. This approach not only builds wealth but also ensures it’s achieved through positive contributions.

Use Technology

Cuban has invested in numerous tech startups that automate, enhance, and innovate traditional business processes. This utilization of technology not only increases efficiency but also opens new revenue streams.

Maintain Liquidity

Cuban stresses the importance of maintaining liquidity in your finances. Having accessible cash allows you to take advantage of sudden opportunities or weather unexpected downturns. This flexibility is a key component of a robust financial strategy.

Learn from Mentors

Having mentors is invaluable, Cuban says. He advocates finding mentors who have achieved the goals you aspire to. Their guidance can help you avoid common pitfalls and accelerate your journey toward wealth.

Stay Patient

Patience is a virtue in wealth accumulation, emphasizes Cuban. He notes that overnight success is rare, and real wealth is built over time. Staying patient allows your investments to mature and your efforts to culminate in substantial wealth.

powbet games offer a fun mix of exciting options for all types of players. The platform is easy to use, making the gaming experience enjoyable and smooth.