A Supreme Court ruling this week ensured the continued operating capabilities of the Consumer Financial Protection Bureau (CFPB), which has long been a target of conservative lawmakers since its inception in 2011.

Though the case was brought by payday lender companies and focused on particular issues relevant to that practice, the overall decision granted approval to the heretofore controversial funding mechanisms for the CFPB, which conservatives have long labeled the “Consumer-Protection Czar.”

Case Before Supreme Court

Payday lenders initiated the particular case the Supreme Court reviewed this week. The payday lenders opposed a rule by the CFPB that prevented them from withdrawing funds directly from borrowers’ bank accounts, and claimed that the CFPB was unconstitutional based on the fact that it is funded by the Federal Reserve rather than through Congressional appropriations.

Business Community’s Mixed Reactions

Some business groups weighed in with support for the payday lenders, stating that the CFPB’s rules are unconstitutional based on its unique funding structure.

Business Interests Opposed to Payday Lender Position

Other businesses regulated by the CFPB, however, stated that a Supreme Court decision undermining the constitutionality of the CFPB could lead to a larger destabilization of consumer protections and the financial and regulatory certainty imperative for a strong marketplace.

Supreme Court Upholds CFPB’s Funding

After hearing arguments, the Supreme Court dismissed the CFPB challenge based on how the agency receives federal money. In doing so, the court claimed that the funding structure is not unconstitutional and laid to rest a long-debated question.

Justice Thomas Leads Majority Opinion

The court voted 7-2, with Justice Clarence Thomas writing the majority opinion and Justices Samuel Alito and Neil Gorsuch dissenting. More often than not, those three Justices often end up on the same side of the decision, showing the divisiveness of this issue for traditional conservatives.

Origins of the CFPB

In the wake of the 2008 financial crisis, Congress passed landmark legislation to overhaul the regulatory structure of the financial services industry. The resultant legislation, the Dodd-Frank Wall Street Reform and Consumer Protection Act, authorized the creation of the CFPB to oversee consumer finance industries, including mortgages and car loans.

Reactions to the Ruling

Democratic Senator Elizabeth Warren is credited with creating the CFPB during the legislative process, culminating in the Dodd-Frank Act. The CFPB claims that since its inception in 2011, the bureau has safeguarded at least $19 billion, which has been returned to consumers.

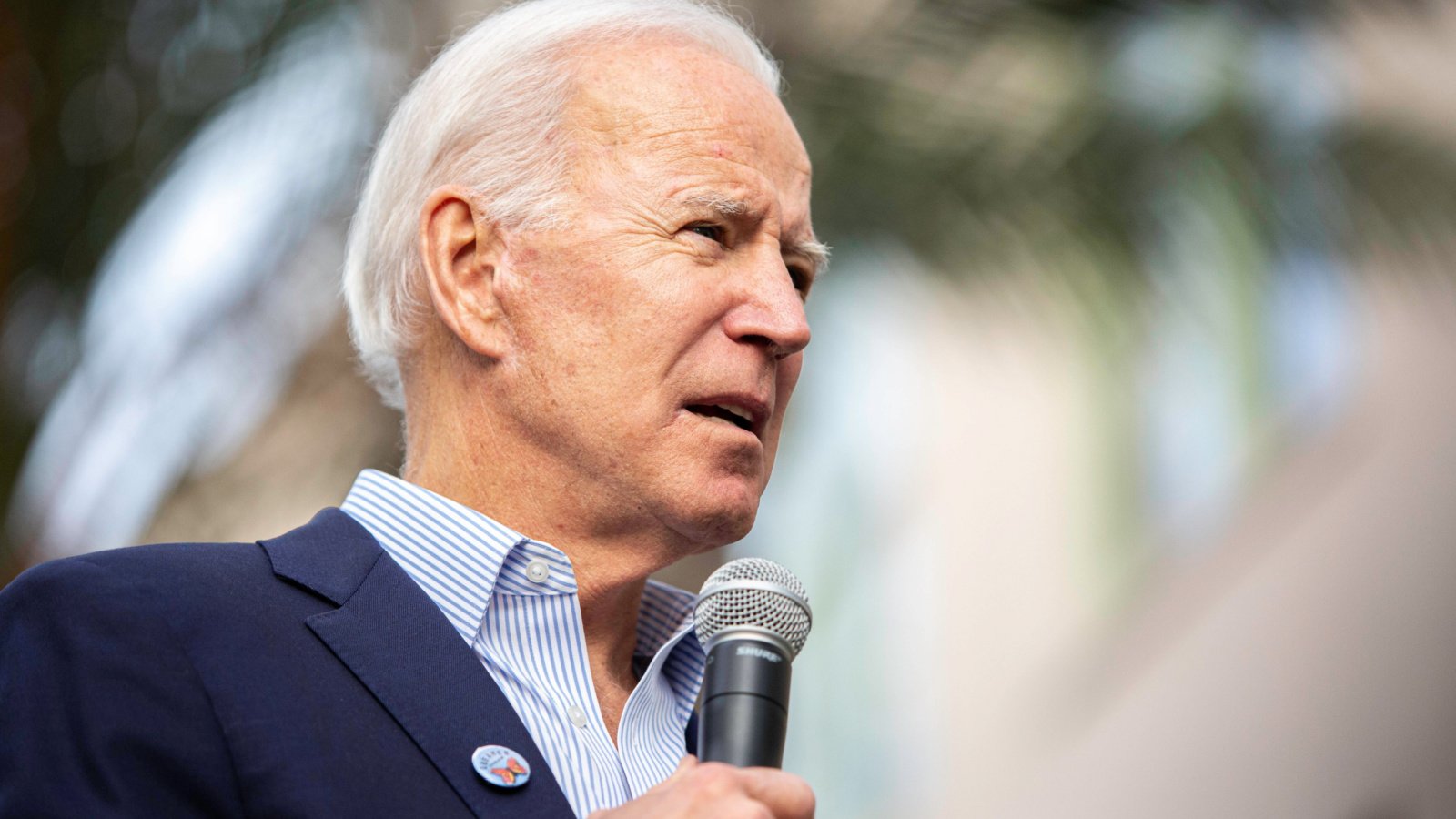

Biden and Warren Celebrate Judicial Victory

Senator Warren praised the Supreme Court’s decision to maintain the CFPB’s structure and authority. President Joe Biden also stated that the decision represents a victory for consumers.

Lower Court’s Novel Ruling Reversed

Prior to being heard by the Supreme Court, a federal appeals court in New Orleans deemed the CFPB’s funding mechanism unconstitutional for violating the Constitution’s appropriations clause, which lays out the approved funding methods for federal programs, agencies, and bureaus. The Supreme Court overturned the lower court’s decision.

Historical Context in Majority Opinion

Justice Thomas upheld the CFPB’s funding mechanism in his majority opinion by citing early constitutional practices and historical appropriations passed in the First Congress. Therefore, precedents exist, and there is no constitutional conflict, according to Justice Thomas and the six other Justices who voted with him.

Dissenting Opinion

In opposition to the majority and several of his conservative colleagues on the bench, Justice Alito argued that the structure of funding for the CFPB means that the bureau operates outside of congressional oversight, which makes it an unconstitutional funding structure.

Lengthy Deliberations

The decision has been a long time coming, as the case was heard seven months ago. In addition to Justice Thomas’s majority opinion, Justices Elena Kagan and Ketanji Brown Jackson penned separate opinions in line with the majority, and Justice Alito submitted an extensive dissent.

Consumer Advocacy Groups Applaud

Consumer groups praised the Supreme Court ruling. CFTC officials capitalized on the victory to emphasize the bureau’s role and commitment to protecting consumers against predatory financial services and general marketplace practices.

Positive Economic Impact

Other commentators, especially from consumer advocacy groups, expressed positive sentiments about the prospects for the CTFC to continue providing consumer protection services. They also condemned payday lenders and other business interests trying to circumvent oversight and regulation, such as in this case of challenging the legitimacy of the CFPB over the bureau’s restrictions on the payday lending business model.

Previous CFPB Case

This is not the first case involving the CFPB that the Supreme Court has heard. In 2020, the Court ruled that the president could remove the director. The CFPB was permitted to continue operations.