As consumer costs keep climbing, many middle-class families feel the pinch. From rising expenses on necessities to the increasing cost of luxuries, many things could become less affordable in the coming years.

Prices for everyday items have jumped by an average of 15% in the past two years alone.

Keep reading to see what might be out of reach for the middle class in the near future.

New Cars

As technology pushes production costs higher, new car prices have surged significantly. In 2023, the average cost of a new vehicle exceeded $47,000, with further increases expected. To cope with these rising prices, many middle-class buyers may need to explore used or certified pre-owned cars as more affordable alternatives.

Live Entertainment

Ticket prices for concerts and sports events are rising, making live entertainment less affordable. As a result, attending these events may become a rare treat rather than a regular activity, prompting families to seek more budget-friendly options like watching from home.

University Education

Tuition fees for private colleges now exceed $50,000 per year. With costs rising, more middle-class families are relying more on loans, making higher education increasingly difficult to afford.

High-End Electronics

Smartphone prices have surged by 20% over the past two years, and other high-end electronics like computers and tablets also continue to rise. As a result, middle-class consumers may need to adjust their expectations or postpone purchases.

Home Ownership

The median price of a home has surpassed $400,000, pushing the dream of home ownership further away for the middle class. With prices rising faster than incomes, many will struggle to buy a home shortly.

Organic Foods

As organic products become more popular, their prices are rising. Middle-class families might find it harder to afford these items, with organic foods increasingly being seen as a luxury.

Sustainable Living Products

Sustainable products, such as biodegradable goods and eco-friendly household items, often come with higher price tags. Items such as compostable utensils to energy-efficient appliances are designed to reduce environmental impact but can be costly. This higher cost could make it difficult for budget-conscious families to adopt eco-friendly practices.

Retirement Savings

Living costs are making it harder for middle-class families to save for retirement. With over 40% of middle-aged Americans lacking retirement savings, this could lead to financial difficulties in later years.

Health Insurance

Annual premiums for health insurance now exceed $22,000 for families. This growing expense strains middle-class budgets and could force many to cut back on other essential needs.

Electric Vehicles (EVs)

Electric vehicles are getting pricier, with average costs now around $56,000. As these prices keep rising, many middle-class families might struggle to justify the expense of an electric car.

International Travel

The cost of traveling abroad is increasing due to higher fuel prices and inflation. Many families may find international vacations a rare luxury instead of a regular occurrence.

Private Schools

Private school tuition is increasing each year, making it harder for middle-class families to afford. If this trend continues, private education might become available only to those with higher incomes.

Premium Healthcare

Top medical services are becoming increasingly costly, potentially creating a healthcare system where only the wealthy can afford high-quality care. As basic services also become too expensive, many families will fine fewer options available.

Green Energy Solutions

Initial costs for green energy solutions like solar panels are high. With decreasing subsidies, these options might become available only to wealthier households. This shift could make it harder for middle-class families to invest in sustainable technologies, further widening the gap in green energy adoption.

Gourmet Dining

Dining at high-end restaurants is becoming more expensive as ingredient costs and exclusivity rise. For many, gourmet dining might turn into an occasional splurge rather than a regular outing.

Luxury Goods

The gap between luxury and everyday products is widening, with designer items becoming increasingly expensive. Middle-class consumers may find themselves priced out of luxury goods. To manage this, they might need to explore lower-priced brands that offer comparable quality.

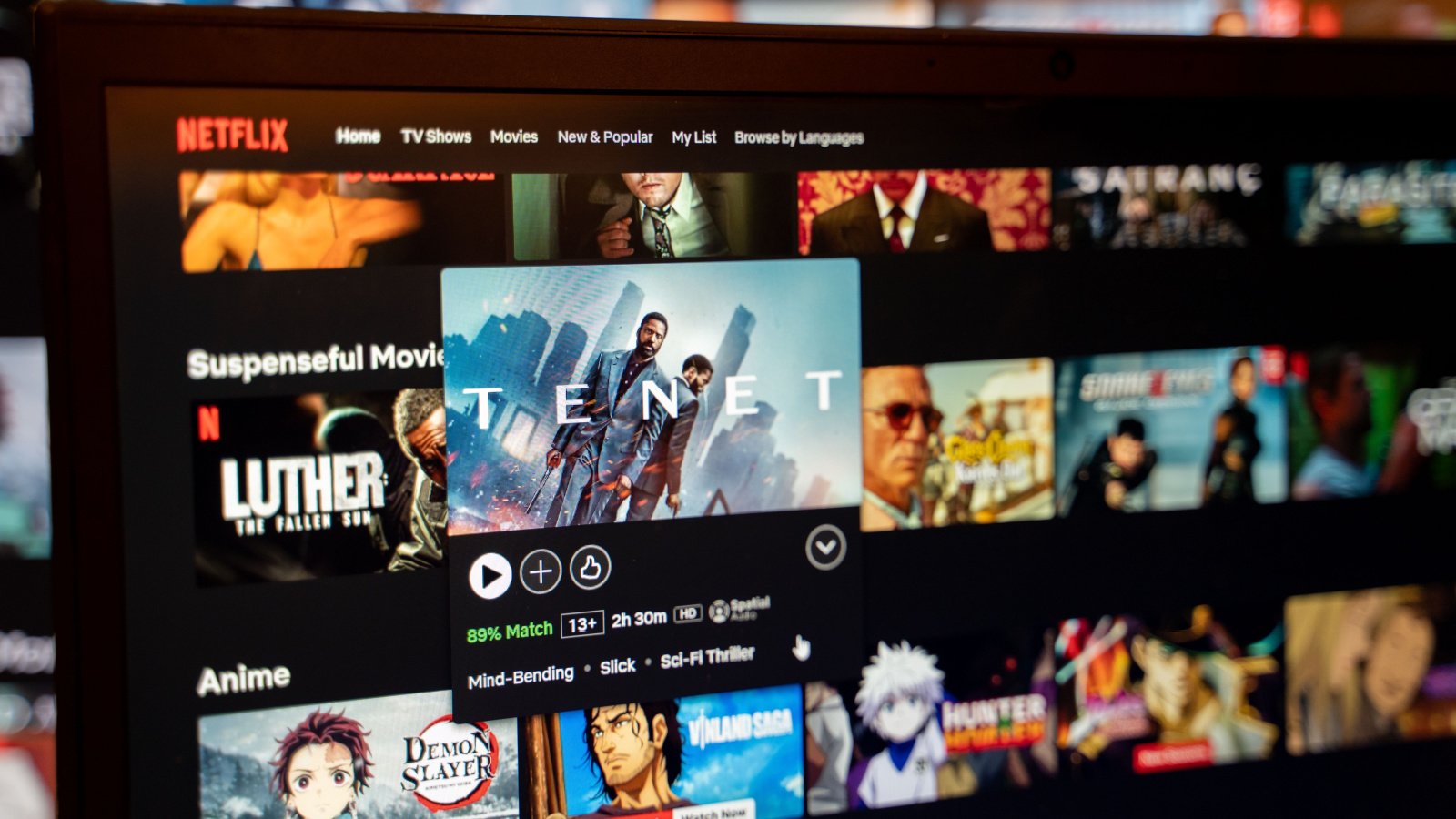

Subscription Services

Fees for streaming and subscription services are increasing, adding to the financial burden on middle-class families. What was once an affordable entertainment option may soon become a significant expense.

Specialty Fitness Classes

Boutique fitness classes, such as CrossFit or Pilates, are becoming more costly. As prices rise, these classes are less accessible to the average consumer. This trend may force many to seek more affordable fitness options or scale back on their wellness routines.

Pet Care

Costs for veterinary services and premium pet treatments are climbing, putting a strain on middle-class pet owners. This trend also affects expenses like boarding and doggie daycare, which are becoming pricier. As these costs rise, many families might struggle to keep up, potentially leading to fewer people being able to afford pets.

Art Collecting

Art prices are being driven up by wealthy buyers, making collecting increasingly expensive. Middle-class enthusiasts may find it harder to participate in art collecting as prices continue to rise.

Advanced Education Courses

Professional development and advanced education are becoming pricier. Without corporate sponsorship, middle-class professionals might struggle to afford these essential courses for career advancement.

Venture into the breathtaking galaxy of EVE Online. Shape your destiny today. Create alongside thousands of players worldwide. Join now