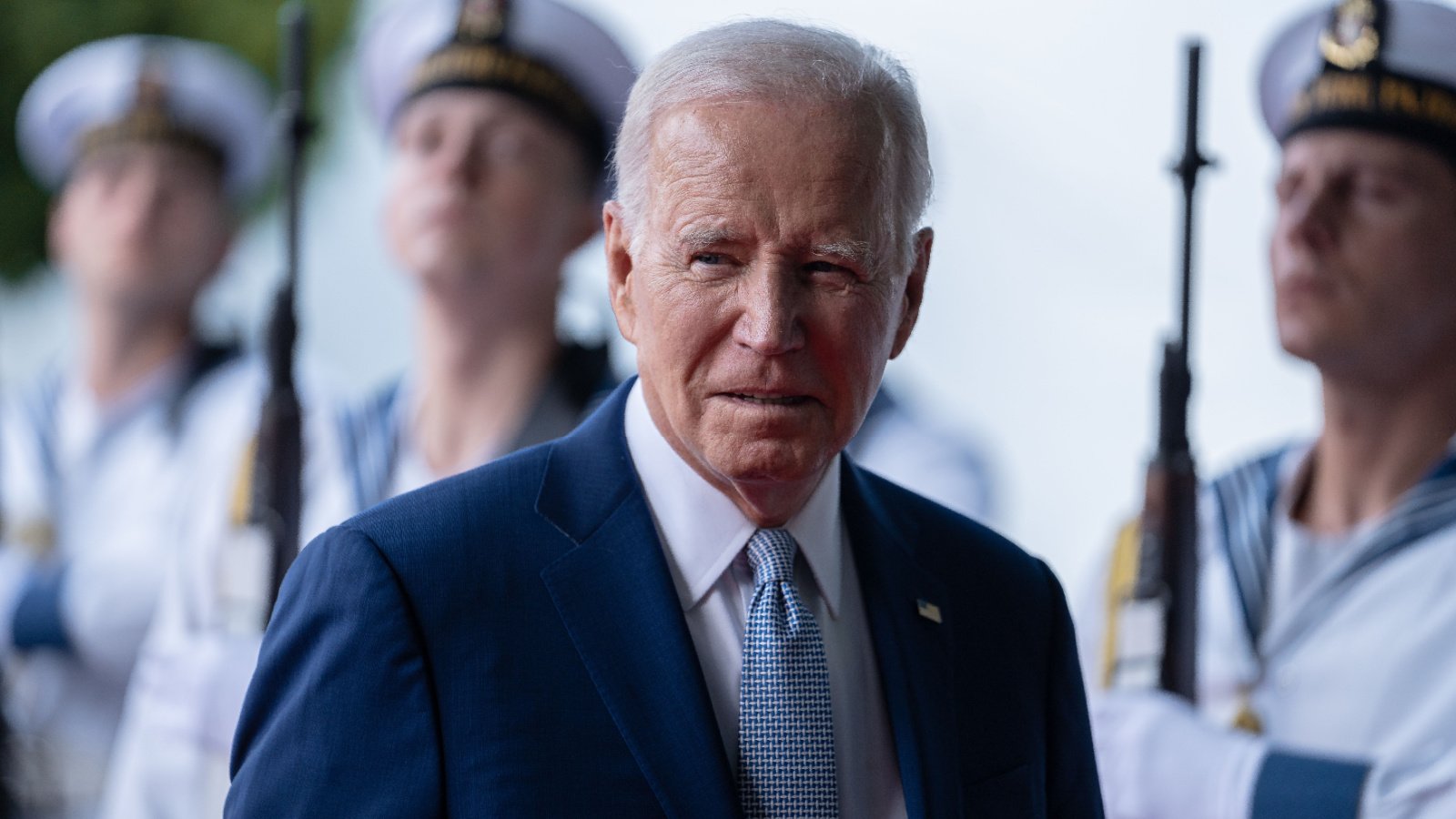

In a bold move to address the growing concern of student loan debt, President Biden has unveiled a new repayment plan that promises relief for millions, sparking a conversation on the future of higher education financing. With stakes this high, the implications for American families and the economy are profound.

Swift Action on Student Debt

The Biden administration has kicked off the ambitious SAVE program to lighten the student debt load for thousands. Borrowers earmarked for relief started receiving email notifications on Feb 21, signaling a significant advance in the administration’s educational policy.

SAVE Program Surprises Early

Originally slated for a July start, the SAVE program’s timeline was expedited, showcasing the administration’s dedication to addressing student debt swiftly. By February, nearly half a year ahead of schedule, the initiative was already in motion, ready to make a substantial impact on borrowers’ lives.

Debt Forgiveness Begins

In a significant announcement via social media, President Biden shared that the first beneficiaries of the SAVE program would see their debt forgiven. Those who have paid off loans of $12,000 or less over ten years are starting to receive notice of their financial relief, marking a hopeful beginning for many.

Biden’s Message of Hope

As part of the first forgiveness wave under the SAVE plan, $1.2 billion in student loans will be cleared away. Beneficiaries are receiving personal emails from President Biden, informing them of their qualification for early loan forgiveness. This move reinforces the administration’s commitment to making education more accessible and affordable.

Transforming Lives Through Debt Relief

President Biden’s heartfelt message to borrowers underscored the profound impact of easing student loan debt. He shared touching stories from countless individuals who expressed that debt relief would significantly improve their ability to support families, purchase homes, start businesses, and pursue life’s milestones that were previously on hold.

A Surge in Enrollment

The new SAVE repayment plan has seen a remarkable response, with over 7.5 million people signing up. This overwhelming participation underscores the critical need for such initiatives, highlighting the plan’s appeal and the urgent demand for student debt solutions.

A Gesture of Support

Biden’s commitment to change was palpable as he recounted the stories of those who’ve had their debts forgiven, a move he described as potentially “life-changing.” During a public appearance, he engaged with the audience, inquiring about their experiences with debt forgiveness, to which many responded positively, showcasing the direct impact of his policies.

Engaging With the Community

Before addressing the urgent issue of student debt at a local library, Biden made a personal connection with the community during a visit to CJ’s Cafe. His approachable demeanor, marked by handshakes, hugs, and selfies, exemplified his commitment to staying grounded and connected to everyday Americans.

Advocating for Climate Action

The journey continued to San Francisco, where Biden, accompanied by former House Speaker Nancy Pelosi, attended a fundraiser focused on combating climate change. His speech to donors emphasized the administration’s dedication to environmental sustainability, linking it to broader policy goals.

Navigating Legal Challenges

Despite facing legal obstacles, including the Supreme Court’s rejection of a more comprehensive loan forgiveness plan, Biden remained undeterred. He introduced the new loan repayment plan as a viable alternative, leveraging existing legal frameworks to deliver relief without overstepping judicial boundaries.

A Detailed Path to Forgiveness

The SAVE plan outlines specific criteria for loan cancellation, targeting those who borrowed $12,000 or less for college and have made a decade of payments. The plan also accommodates borrowers with larger debts, extending forgiveness timelines in a fair and structured manner, ensuring a wide-reaching impact.

A Commitment to Reform

Biden’s unwavering resolve to “fix our broken student loan system” shines through his efforts to circumvent legal hurdles and provide meaningful relief. His strategies reflect a deep understanding of the challenges facing borrowers and a determined approach to offer solutions within the constraints of the current legal landscape.