Democratic Presidential Nominee Kamala Harris announced this week that as President she would raise the corporate income tax rate to 28 percent. While in office, Trump lowered the corporate tax rate to 21 percent, and suggested increasing revenues from imposing tariffs on imported goods and services.

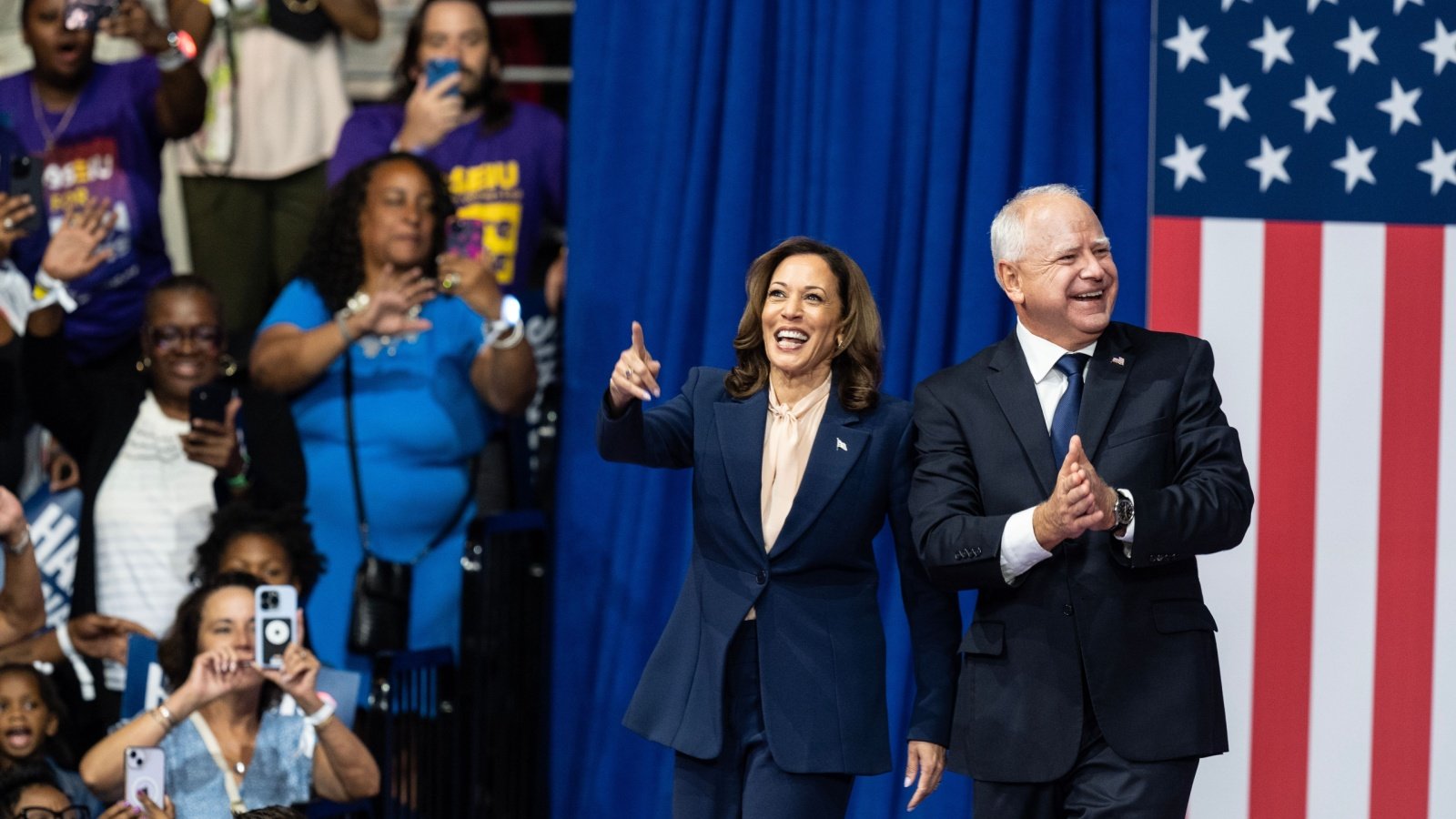

Harris-Walz Campaign Focuses on the Middle Class

The Harris-Walz campaign stated, “As President, Kamala Harris will focus on creating an opportunity economy for the middle class that advances their economic security, stability, and dignity.”

Harris Expounds on Policy Priorities

In the past week, Harris has expounded on potential policy priorities once she wins office, including prohibiting “price gouging.” She proposed the corporate tax increase to pay for some of the Democratic priorities she would like to see implemented.

CBO Study Supports Revenue Generation from Corporate Tax Hike

A 2018 study by the nonpartisan Congressional Budget Office concluded that a one percent increase in the corporate tax rate would generate $100 billion in additional tax revenue for the federal government over a decade.

Harris Tax Proposal Contrasts with Trump’s 2017 Tax Cuts

The Harris tax proposal differs significantly from that of former President Donald Trump. In 2017, Trump cut corporate taxes from 35 percent to 21 percent.

Trump Suggests Further Corporate Tax Cuts

Additionally, Trump has spoken at a business roundtable about cutting the corporate tax rate further to 20 percent.

Trump Campaign Criticizes Harris’s Tax Plan

Trump’s campaign responded to the proposed Harris tax increase, saying it amounts to “a punishment to American companies and workers and another gift from Kamala to China.”

Economic Challenges Under the Biden Administration

The Trump team pointed out that businesses have already suffered high inflation, increased interest rates, and higher energy prices under the Biden Administration. This economic environment has led many companies to export jobs internationally and lay off American workers.

Harris Campaign Defends Tax Increase Proposal

The Harris campaign defended its tax increase proposal, saying, “Unlike Donald Trump, whose extreme Project 2025 agenda would drive up the deficit, increase taxes on the middle class by $3,900, and send our economy spiraling into recession– her plan is a fiscally responsible way to put money back in the pockets of working people and ensure billionaires and big corporations pay their fair share.”

Upcoming Expiration of Trump Tax Cuts

Many portions of the Trump tax cuts will expire in 2025, and the next President will significantly influence shaping the tax environment for the next decade or so, constituting a major issue in the election.

Trump Pledges Further Tax Cuts

Trump pledged to his voter base to cut taxes, saying, “Our plan will massively cut taxes. I gave you the best tax cut in history.” Trump also pledged to impose tariffs on goods entering the country to prioritize American-made goods. He proposed legislation called the “Trump Reciprocal Trade Act.”

Harris Campaign Opposes Trump’s Tariff Proposal

The Harris camp has opposed Trump’s tariff proposal, claiming it would “punish middle and working-class Americans” purportedly by eliminating cheaper imported goods from the marketplace rather than raising revenue by increasing taxes on corporations and “the richest Americans.”

Harris’s Tax Stance Aligns with Biden’s Policies

Harris’s tax stance is in line with that proposed by President Biden. One of the most effective criticisms lobbied against Harris in the current electoral environment is that her policies are already in place, as represented by the Biden-Harris Administration. Therefore, voting Harris into office is a vote for the continuation of the current Administration, for good or for ill.

Harris Supports Expanding Social and Economic Reforms

Harris has said, as has current President Biden, that she would support expanding the child tax credit, decreasing medical debt, creating more affordable home ownership, and reducing corporate price gouging and monopolies.

Glücksspiel birgt das Risiko von Abhängigkeit, und jüngere Menschen sind besonders anfällig für impulsives

Verhalten und Kontrollverlust. Das bedeutet, dass Online-Casinos in jedem

EU-Land strenge Altersverifikationssysteme implementieren müssen, um sicherzustellen, dass nur berechtigte Spieler teilnehmen können. Zwar schreibt die EU kein festes Casino Alter vor, aber sie

verpflichtet alle Mitgliedsstaaten dazu, Maßnahmen zu ergreifen, die den Zugang für Minderjährige wirksam verhindern. Während

die EU bei landbasierten Casinos den Mitgliedsländern freie

Hand lässt, gibt es für Online-Casinos klare Richtlinien zum Jugendschutz.

Diese Maßnahmen gewährleisten, dass jedes Land trotz eigener

Gesetze ein verantwortungsvolles Glücksspielumfeld für seine Bürger schafft.

Dabei müssen die EU-Länder sicherstellen, dass strikte Kontrollmechanismen vorhanden sind, um das festgelegte Casino Alter

zu überwachen und durchzusetzen.

Das Bundesgesetz regelt in Deutschland die Grundlagen des Jugendschutzes,

aber es legt kein einheitliches Mindestalter für Casinos fest.

Während die meisten Bundesländer den Zugang zu Casinos ab

18 Jahren erlauben, setzen einige, wie Bayern und Baden-Württemberg, ein Mindestalter von 21 Jahren voraus.

In den meisten Ländern beträgt das Mindestalter 18 Jahre,

doch einige Plattformen setzen ein höheres Limit von 21 Jahren. In Nevada,

wo das Las Vegas Casino Alter bei 21 Jahren liegt, finden Spieler einige der Spielautomaten mit den besten Auszahlungsquoten. Das Casino Spanien Alter liegt

einheitlich bei 18 Jahren, was Volljährigen den Zugang ermöglicht.

References:

https://online-spielhallen.de/alles-wichtige-zur-24-casino-auszahlung/

You get more benefits as you move up levels, such

as personalised offers, more trades, and deals that are

only available to people at that level. A reward program pays people who keep going back to the

casino. Because the deals change all the time, you can always

find new and fun ways to improve your game. Each bonus is

tailored to a different person so that everyone gets something of value.

Players who keep coming back can get reload offers, free spins,

and other rewards for being loyal. People who want

to have fun at a casino should go there because it cares about being

fair and making people happy.

Casino enhances this experience with opportunities for Stay Casino free spins, increasing chances to win without

extra bets. That’s why casinos are always fun and full of options, no matter where you are or what

you’re doing. This means that you can always get the thrill of the casino on your phone with just a few taps.

References:

https://blackcoin.co/39_best-vip-online-casino-2022_rewrite_1/

Both table games and slot machines are available at the regular yet entertaining gaming floor.

The other is Boardwalk Gaming, an exclusive VIP gaming area that offers a real red-carpet treatment and experience.

For those seeking proximity to the water, the Water Edge rooms provide serene river

views, while the Motor Inn rooms offer comfortable and affordable options

with easy access to the resort’s facilities.

Each online casinos is also monitored by independent testing and auditing agencies, such as eCOGRA (eCommerce Online Gaming Regulation and Assurance), to assure that player protection, fair gaming and responsible operator conduct all meet gaming industry standards.

Yes, players can access self-exclusion options,

deposit limits, and session reminders to ensure responsible gambling behavior.

Yes, our customer service is available around the clock via live chat, email, and

phone to assist with any issues or questions.

We aim to make navigation, communication, and gameplay easy and inclusive for players from different backgrounds, enhancing the global appeal of our casino.

Play slots, table games, and more through our secure and immersive online

casino platform. Both Tasmanian casino venues boast multiple blackjack tables across their gaming floors

and both complex’s offer accommodation, fine dining restaurants

and exclusive bars, shows and live entertainment, and much more.

This large range of options means you’ll be able to enjoy some of

the latest new games, as well as best-loved classics.

References:

https://blackcoin.co/welcome-to-phcasino-your-premier-destination-for-exciting-gaming-adventures-and-fantastic-cash-prizes/

online casino usa paypal

References:

myjobsquote.com

online casino mit paypal einzahlung

References:

https://www.revedesign.co.kr/bbs/board.php?bo_table=free&wr_id=319313