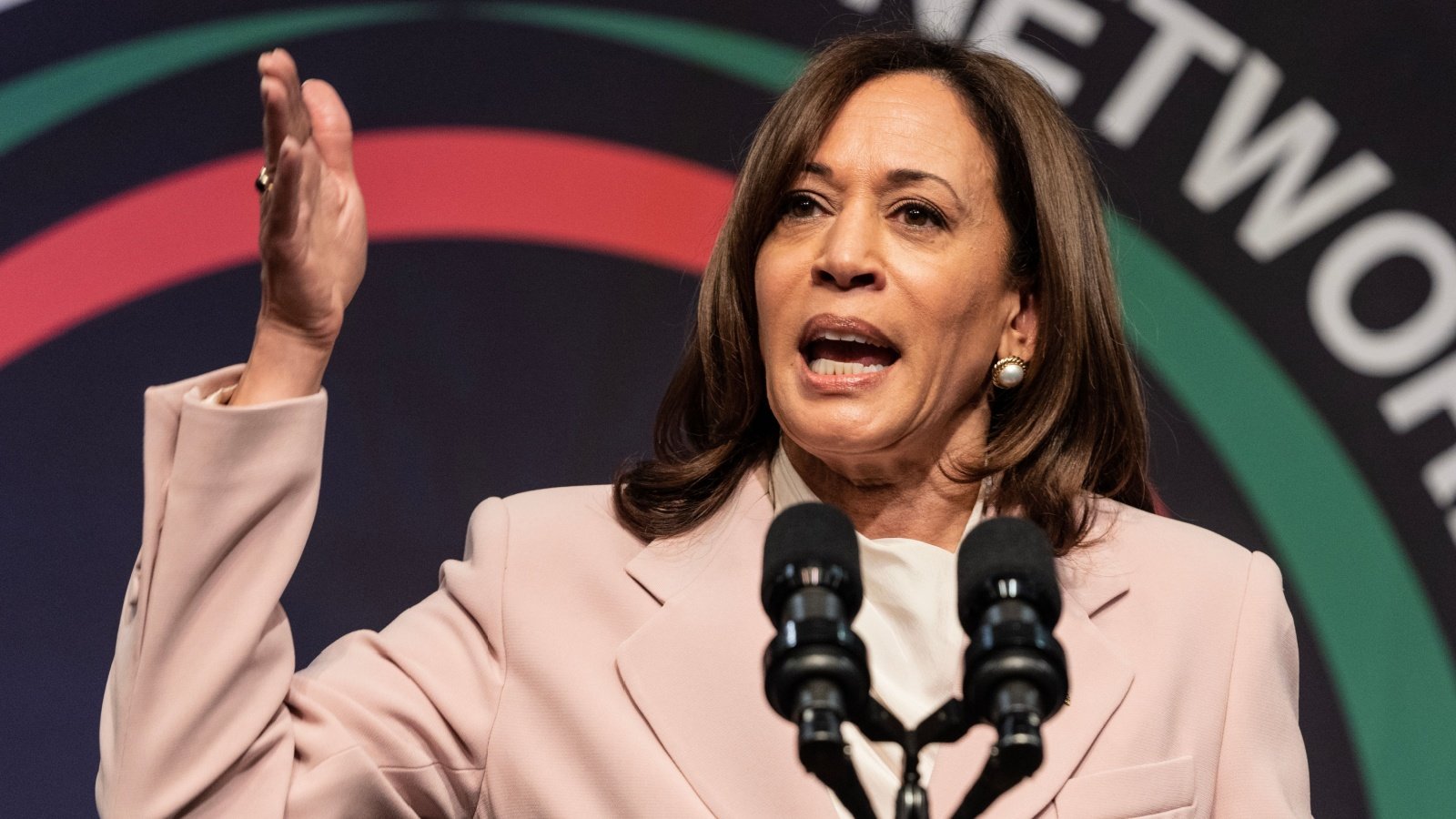

Democratic Presidential Nominee Kamala Harris has embraced Republican Nominee Donald Trump’s plan to exempt tips from federal taxation. The policy is now embraced by both candidates, with some differences between the campaigns, and is expected to reduce federal revenues by anywhere from $100 billion to $200 billion over ten years.

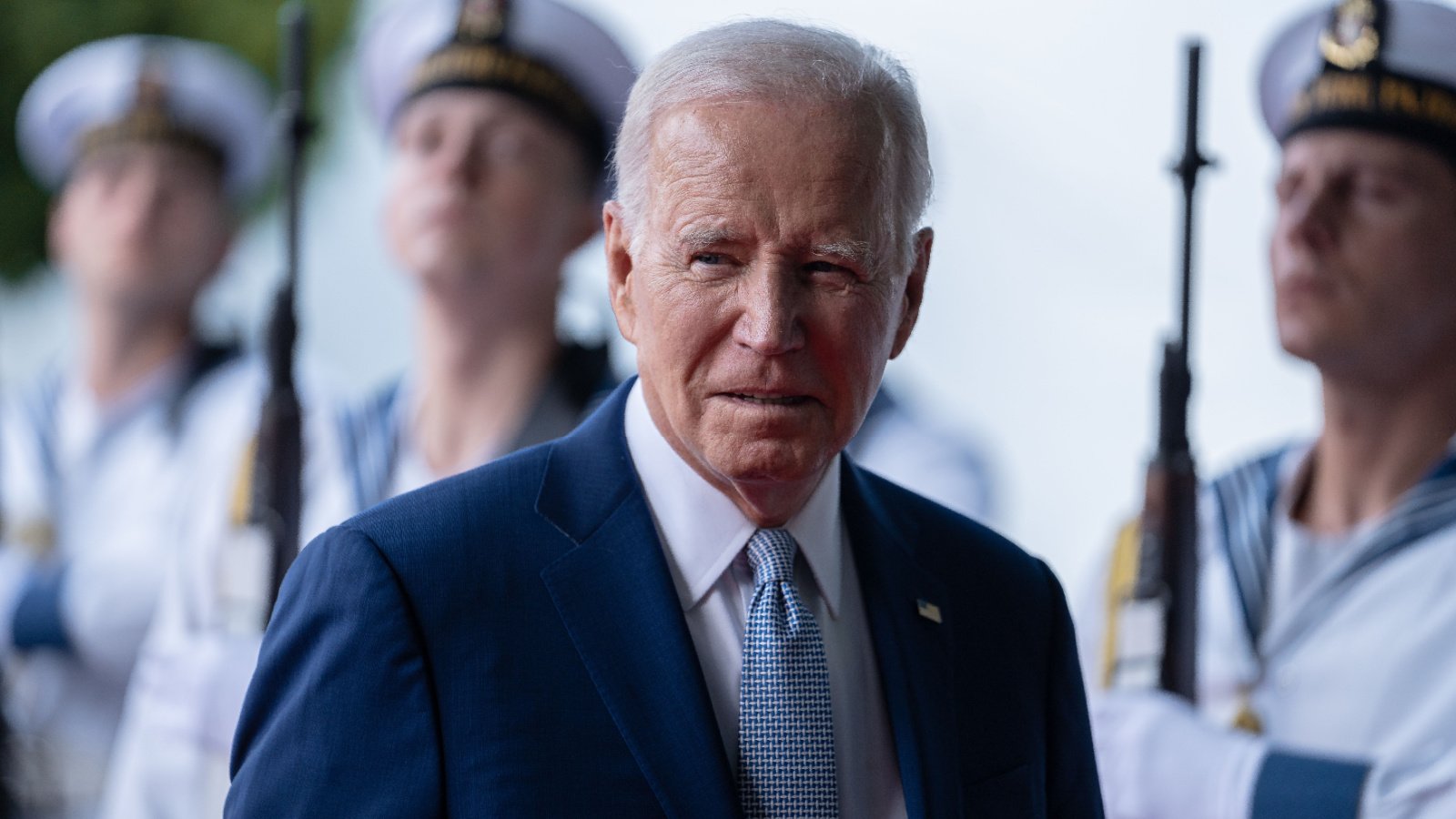

Trump’s Announcement and Justification

Trump announced the initiative earlier this year, crediting a restaurant server. He said, “You will be very happy for those hotel workers and people that get tips.”

CRFB Revenue Loss Estimate

After Trump’s campaign promise, the Committee for a Responsible Budget (CRFB) estimated that tax revenues would decrease from $150 billion to $250 billion over ten years if tips were exempted from federal income and payroll taxes.

Harris’s Campaign Variation

Harris’s campaign promise differs in that campaign officials told the CRFB that tips would be exempt from income tax but not payroll tax, which averages close to 15 percent.

Harris’s Proposed Limits and Guardrails

The Harris campaign also said that Harris would impose rules on the exemption, including “establishing an income limit and various guardrails on the exemption of tip income from taxes.”

Preventing Abuse of the Tax Exemption

The limits would ensure that compensation schemes do not shift in ways that purposely allow wealthier individuals to take undue advantage of the bill’s intent to aid minimum—and lower-wage workers.

Harris’s Commitment to Income Limits and Wage Protection

A Harris campaign official spoke with the Washington Post about the proposal, saying, “As president, she would work with Congress to craft a proposal that comes with an income limit and with strict requirements to prevent hedge fund managers and lawyers from structuring their compensation in ways to try to take advantage of the policy.”

Harris’s Support for Minimum Wage Increase

In addition to supporting changes to exempt tips from income tax, Harris has also committed to increasing the federal minimum wage.

Harris’s Minimum Wage and Tax Exemption Plan

During her first tour, Harris announced that as President, she would “raise the minimum wage and eliminate taxes on tips for service and hospitality workers.”

Current Federal Minimum Wage

Since 2009, most workers’ federal minimum wage has been $7.25 per hour.

Projected Revenue Impact

According to the CRFB, raising the federal minimum wage and exempting tips from income tax would reduce federal revenues by $100 to $200 billion over ten years.

Potential Changes in Tipping Behavior

The CRFB estimates do not include “changes in tipping behavior,” which would likely accompany a change.

Impact of Future Administration on Payroll Taxes

Regardless of which future Administration takes office, tipping behavior will likely be affected as it permits workers to retain more of their wages.

Potential Worker Savings Under Trump Administration

If the Trump IRS does not impose payroll taxes on tip earnings, the savings to workers—and cost to the government—would be approximately 15 percent higher in a Trump Administration.

Ally Spin Casino kombiniert eine europafreundliche Lizenzierung, eine breite Spielbibliothek und bequeme Zahlungswege,

sodass österreichische Spieler ohne Umwege in vertrauter

Umgebung spielen können. Ergänzt wird das Angebot durch

ein mehrstufiges VIP-Programm, Cashback-Aktionen und wöchentliche Turniere, damit

sowohl Gelegenheitsspieler als auch Highroller dauerhaft attraktive Anreize finden. Gewinne

aus Freispielen müssen vor einer Auszahlung 40 Mal umgesetzt werden. Der Willkommensbonus bei Allyspin Casino besteht aus 3 getrennten Einzahlungsboni im Wert von bis zu 1.000€.

Mit Mindesteinzahlungen ab 10 € und täglichen Auszahlungen von bis

zu 5.000 € (je nach VIP-Level) ist unser Bankprozess schnell, sicher und effizient.

Wir bieten eine Vielzahl von Zahlungsoptionen, darunter Visa,

Mastercard, Bitcoin, Ethereum und benutzerfreundliche E-Wallets wie MiFinity.

Wir bei Ally Spin Casino sind stolz darauf, ein unvergleichliches Spielerlebnis

mit über 5.000 Spielen von Top-Anbietern zu bieten. Bitte spiele verantwortungsvoll und

setze nur Beträge ein, deren Verlust du verkraften kannst.

References:

https://online-spielhallen.de/n1-casino-freispiele-ihr-umfassender-leitfaden/

50+ providers including Pragmatic Play, NetEnt, Evolution Gaming,

BGaming, Yggdrasil, Playtech, Betsoft, Nucleus Gaming King Billy Casino has firmly established itself as a prestigious online gaming destination since its opening in 2017.

Dive headfirst into the exhilarating journey that awaits, assured that King Billy

has smoothed your path, illuminated your landscape, and prepared your gaming throne with utmost care.

Our mission is to offer a seamless, welcoming entry into your tailored King Billy Casino experience.

With advanced encryption and vigilant session monitoring, your

focus remains fiercely fixed on each moment of joy.

Available 24/7 through live chat and email, our seasoned

experts are poised to deliver prompt, professional solutions to any login-related queries.

The platform’s operational structure aligns with Australian player expectations regarding transparency, fairness, and responsible gaming practices.

Chicken Road provides a unique twist on crash gameplay, featuring a grid-based format where players predict

safe paths before bombs appear. Crash games represent a growing

category at King Billy Casino, offering fast-paced gameplay with multiplier-based winning mechanics.

Click it, create a new password following the requirements (at least 8 characters with a mix of letters and numbers), and you’re back in business.

Click the “Forgot Password” link on the login page and

enter your registered email address. When you genuinely can’t remember

your password, King Billy Casino makes recovery simple.

Then verify your password – watch out for caps lock and

make sure you’re not accidentally adding extra

spaces. Many people have multiple email accounts and mix them up.

If you see an “Invalid login” message, double-check your email address first.

References:

https://blackcoin.co/woospin-premier-pokies-paradise-for-aussie-players-in-2025/

“People make a conscious decision to go to casinos,” he said.

“Having the casino allows you the cash flow to do other things,” he said.

He will spend a minimum of $20 million to overhaul the design and put in new restaurants and bars, “which is what we specialise in our hotels in Perth and Melbourne”.

And although the venue gets 2,000 visitors a day, it has struggled to encourage

spending outside of the 350 poker machines and 50 gaming tables, he

said. Mr Morris said the waterfront casino is the “best spot in Townsville” but a dated design has

not made enough of the views out to Magnetic Island.

This article about a hotel or resort in Oceania is a stub.

Mr Morris also said he is against the installation of pokies

in pubs but he does not have a problem with them in casinos.

Let us take care of the whole wedding experience for you and your

guests. Sign up for news, offers, and invitations to the things we love to share and enjoy

References:

https://blackcoin.co/casino-wharf-fx-a-comprehensive-overview/

online casino for us players paypal

References:

jozhi.org

online casino mit paypal einzahlung

References:

ttceducation.co.kr