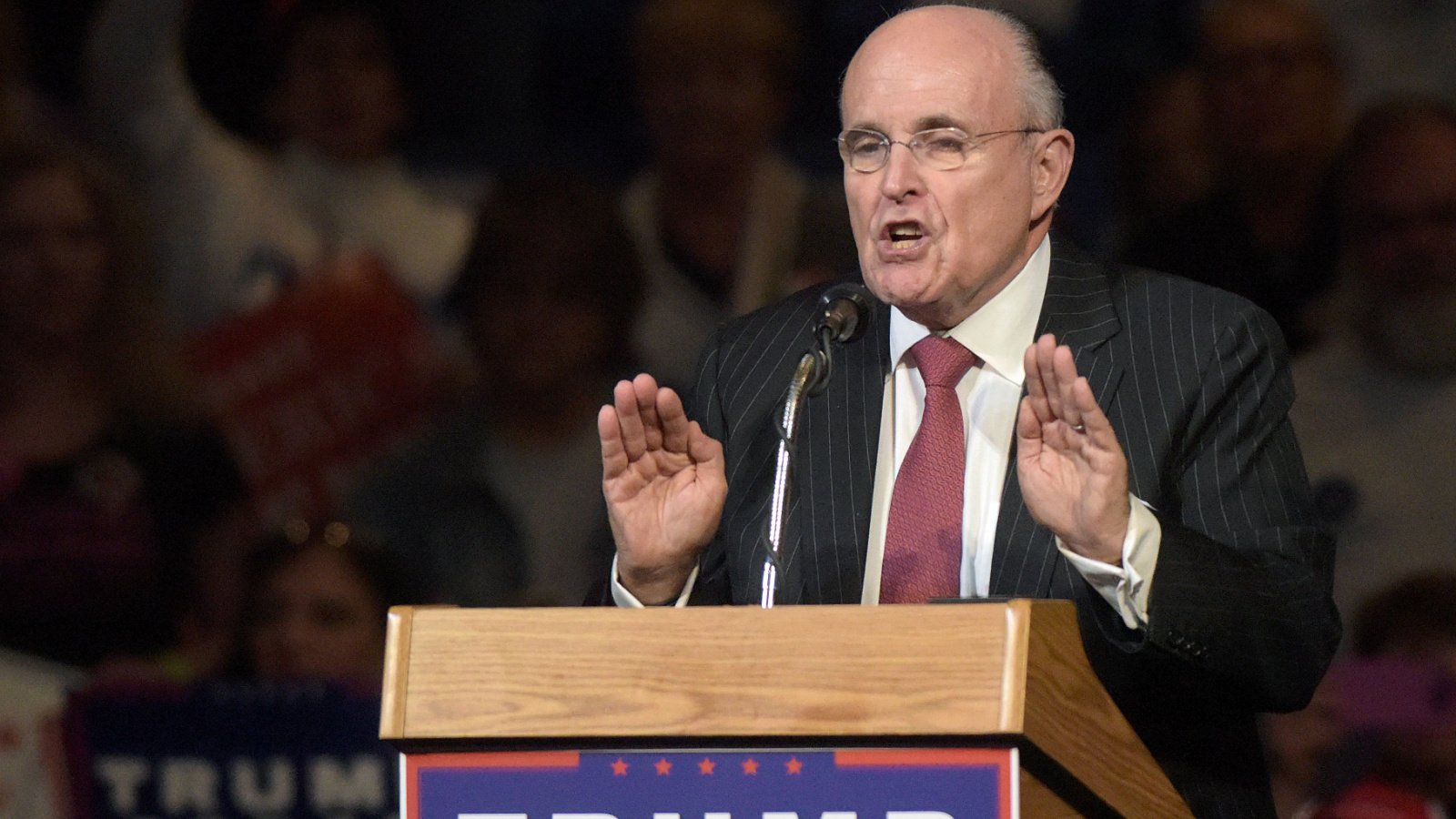

Rudy Giuliani’s legal troubles continue to mount with a recent $400,000 settlement to end his bankruptcy case and his disbarment in New York. Facing criminal charges in Georgia and Arizona, the former mayor’s financial woes reveal nearly $153 million in debts. As he navigates these challenges, Giuliani’s assets and income sources come under intense scrutiny.

Giuliani Reaches Deal to End Bankruptcy Case

Rudy Giuliani has settled his personal bankruptcy case, agreeing to pay around $400,000 to a financial adviser hired by his creditors. This deal averted a potential probe into the former New York City mayor’s finances threatened by a federal judge.

Court Agreement Filed in White Plains

The settlement was filed Wednesday in federal court in White Plains, New York. This action followed a judge’s decision to dismiss Giuliani’s bankruptcy case for his failure to disclose income sources and comply with court orders.

Judge Demands Resolution Proposal

After the dismissal, Giuliani’s lawyers claimed he couldn’t afford the forensic financial adviser required by bankruptcy laws. Judge Sean Lane then ordered all parties to submit resolution proposals and prepare for a potential hearing on Giuliani’s finances.

Agreement Submitted Just Before Deadline

The agreement, filed just hours before the deadline, awaits the judge’s approval. The deal was a crucial step to avoid further legal complications for Giuliani.

Creditors Include Defamed Election Workers

Creditors Ruby Freeman and Wandrea “Shaye” Moss, who won a $148 million defamation judgment against Giuliani, are among those involved. Giuliani’s false claims about ballot fraud in the 2020 election subjected them to death threats.

Plan to Pay Financial Adviser

Giuliani will give his lawyers $100,000 to pay Global Data Risk, the financial adviser, and cover the remaining expenses from the sale of his New York City apartment or Florida condominium. These properties are valued at $5.6 million and $3.5 million, respectively.

Liens on Properties Ensured

Global Data Risk is authorized to place liens on Giuliani’s properties to secure payment. This measure guarantees that the adviser will receive all due fees.

Financial Adviser’s Expenses Highlighted

Rachel Strickland, representing Freeman and Moss, noted in court filings that Global Data Risk accumulated $400,000 in expenses. This was a significant amount during the bankruptcy proceedings.

Concerns Over Giuliani’s Payment Claims

Judge Lane expressed concerns about Giuliani’s claims of inability to pay. He pointed out that Giuliani has substantial assets to cover these bankruptcy expenses.

Freeman and Moss Pursue Judgment Collection

With the bankruptcy hold lifted, Freeman and Moss are now free to seek enforcement of their $148 million judgment in federal court in Washington, D.C. Their victory had been stalled by the bankruptcy proceedings.

Giuliani’s Ongoing Legal Troubles

The bankruptcy is one of many legal issues for the 80-year-old Giuliani, once known as “America’s Mayor” for his leadership after the 9/11 attacks. His legal woes continue to mount as he faces various challenges.

Disbarment and Legal Challenges

Rudy Giuliani was disbarred in New York after making false statements about Trump’s 2020 election loss. He may also lose his law license in Washington, D.C., following a board’s recommendation for disbarment in May.

Criminal Charges in Georgia and Arizona

Giuliani faces criminal charges in Georgia and Arizona related to efforts to overturn the 2020 election results. He has pleaded not guilty in both cases, maintaining his innocence.

Bankruptcy Filing Details

When filing for bankruptcy, Giuliani listed nearly $153 million in debts, including state and federal tax liabilities and potential lawsuit judgments. He estimated his assets to be between $1 million and $10 million.

Financial Status Revealed

Recent financial filings show Giuliani had about $94,000 cash at the end of May, while his company had around $237,000 in the bank. His primary income source over the past two years has been a retirement account, which had a balance of just over $1 million in May, down from nearly $2.5 million in 2022 due to withdrawals.

Das Restaurant im Barockschloss Klessheim bietet preisgekrönte

Küche in edlem Ambiente. Die Geldspielgeräte und

Terminals entstammen der neuesten Generation, aber

neben Video-Slots werden Sie auch nostalgische Walzengeräte finden. Neben 7 Pokertischen können Sie an jeweils zwei Tischen Tropical Stud und Easy

Hold’em spielen.

Aktionen und Gewinnspiele ändern sich laufend; am besten kurz vor dem Besuch

den aktuellen Kalender prüfen. Gleichzeitig finden Sie trotz der

barocken Architektur ein höchst modernes Spielangebot in der Pracht der Innenräume.

Das Casino Salzburg Schloss Klessheim befindet sich tatsächlich in diesem wunderschönen Barockschloss, ganz wie man sich Österreich vorstellt.

References:

https://online-spielhallen.de/evolve-casino-bonus-codes-ihr-umfassender-leitfaden/

Chatbots can make it easy for users to find information by instantaneously responding to questions and requests through text input,

audio input, or both, without the need for human intervention or manual research.

True to its promise of not requiring any code, the course teaches how

to visually create chatbots with Watson Assistant and how to deploy them online through a handy

WordPress plugin. Learn to create useful chatbots without

writing any code in IBM’s Building AI Powered Chatbots Without Programming course.

Looking to leverage the benefits of chatbots

in your job?

Activate the Search button to allow the AI to browse the

internet for real-time data and events for its answers.

Chat bots can proactively initiate conversations with customers, making them a powerful tool for marketing.

It employs Natural Language Processing (NLP) to interpret text and identify intent, while

machine learning allows it to improve its responses over

time based on past interactions.

References:

https://blackcoin.co/players-club-vip-casino/

Lenovo Digital Workplace Solutions helps organizations quickly gain a competitive edge by relying on Lenovo-managed services

that provide tailorable, people-focused work habitats.

From pocket to cloud, individual to enterprise, Lenovo is taking AI out of abstract headlines and putting its power in the hands of real people, everywhere.

Lenovo’s goal is to positively impact 15 million people by 2025 through the work of global philanthropy partnerships and programs, led by the Lenovo Foundation.

From cities studded with edge computing cabinets that

help stop traffic accidents to a ‘Cyber Space’ room where people interact with

life-size objects on a transparent screen, our whole idea of computing is changing.

Those innovations need to progress in harmony with our planet and its people, and so Lenovo prioritizes corporate citizenship

in all that it does – from exploring net-zero emissions to global

philanthropy. Lenovo is a global technology powerhouse, ranked at 196 in the Fortune Global 500, and a $69

billion revenue company that employs 77,000 people worldwide focused on delivering

“smarter technology for all”.

One such workaround, popularized on Reddit in early 2023,

involved prompting ChatGPT to assume the persona of DAN, an acronym for “Do Anything Now”,

and instructing the chatbot that DAN answers queries that

would otherwise be rejected by the content policy. In one instance, ChatGPT generated a rap in which women and scientists of

color were asserted to be inferior to white male scientists.

These limitations may be revealed when ChatGPT responds

to prompts including descriptors of people.

The reward model of ChatGPT, designed around human oversight, can be

over-optimized and thus hinder performance, in an example of an optimization pathology known as Goodhart’s law.

The Guardian questioned whether any content found on the Internet after ChatGPT’s release “can be truly trusted” and called for government regulation.

In June 2023, hundreds of people attended a “ChatGPT-powered church service” at St.

Paul’s Church in Fürth, Germany. In response, many educators are

now exploring ways to thoughtfully integrate generative AI into assessments.

References:

https://blackcoin.co/classicbig4-casino-holiday-park-in-depth-review/

online betting with paypal winnersbet

References:

https://cvbankye.com/employer/top-paypal-casino-sites-in-canada-for-december-2025

online slots paypal

References:

https://saek-kerkiras.edu.gr/