We all have habits that drain our wallets without even realizing it. From daily routines to overlooked expenses, there are numerous ways we waste money on a regular basis. Identifying these habits can help make smarter financial decisions for significant savings.

According to a recent study, the average person wastes over $18,000 a year on non-essential items and services.

By becoming aware of these everyday money-wasters, you can start making small changes that add up to big savings. Discover some common habits that could be costing you more than you think.

Buying Bottled Water

Many of us grab bottled water for convenience, thinking it’s cleaner than tap water. Interestingly, tap water is heavily regulated and often just as safe. Switching to a reusable bottle can save hundreds of dollars while reducing plastic waste.

Buying New

Opting for brand-new items like a car, electronics, or clothes can be much pricier than buying used or refurbished. Preowned items often perform as well as new ones, allowing you to save money and support a more sustainable lifestyle.

Convenience Foods

Pre-packaged foods are marketed for convenience and quick access but often come with a higher price tag. Preparing from scratch with basic ingredients is more cost-effective and healthier, making meal planning and batch cooking worthwhile.

Disposable Coffee Cups

Buying coffee in disposable cups is a quick fix, but the cost can add up over time. Investing in reusable coffee cups can earn you discounts at coffee shops, and this small change can lead to significant savings.

Ignoring Discounts and Coupons

It’s easy to overlook discounts, coupons, and loyalty programs, but these savings can really add up. Taking time to search for deals can result in noticeable reductions in your expenses over time.

Unused Gym Memberships

Signing up for a gym membership starts with the best intentions, but many end up rarely using it. With many memberships costing over $50 a month, exploring at-home workouts or pay-per-class options may be more practical and cost-effective.

Buying Brand-Name

Brand-name products generally come with a higher price without a noticeable quality difference compared to generic brands. Choosing generic options can lead to substantial savings while still getting the quality you need.

Throwing Away Leftovers

Food waste contributes to unnecessary grocery expenses. Instead of throwing away leftovers, repurposing them into new meals can save money and reduce waste, making the most of your food budget.

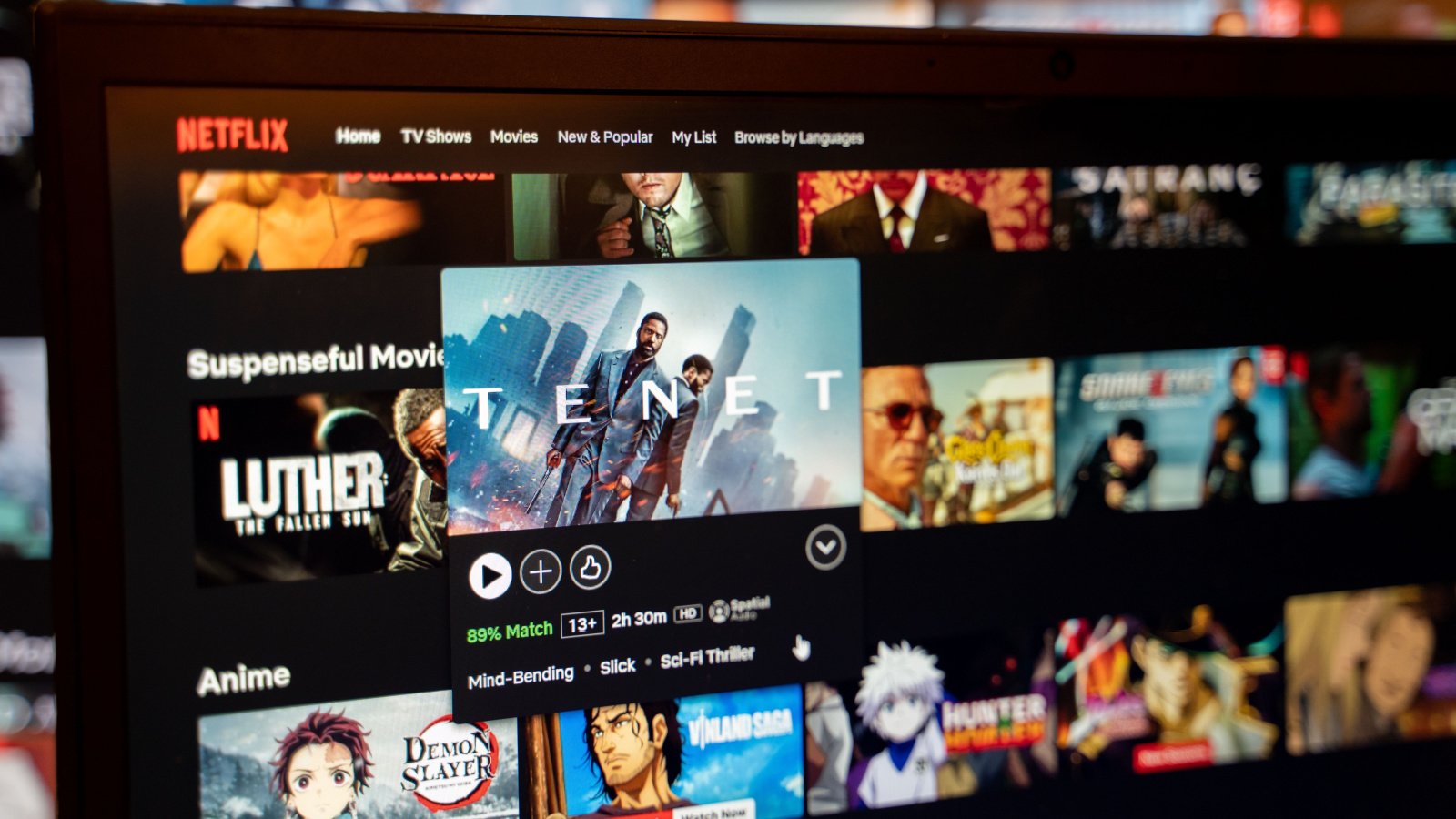

Ignoring Subscription Services

Small monthly charges from streaming services, magazines, or apps easily get forgotten. Regularly reviewing and canceling unused subscriptions can help you save hundreds of dollars annually.

Heating and Cooling Usage

Running heating and cooling systems more than necessary can lead to high energy bills. Simple adjustments like tweaking the thermostat, using fans, and dressing appropriately can significantly reduce utility costs.

Extended Warranties

Retailers push extended warranties, but these usually aren’t worth the extra cost. Many products come with sufficient standard warranties, and studies show most people rarely use extended warranties, making them an unnecessary expense.

Eating Out Frequently

Frequent dining out, whether at restaurants or fast food, can quickly strain your budget. Cooking meals at home saves money and allows you to make healthier choices. Planning and preparing meals ahead of time can further enhance savings..

ATM Fees

Using out-of-network ATMs can result in hefty fees that add up over time. Planning to use your own bank’s ATMs or taking advantage of cashback options at stores can help keep more money in your pocket.

Impulse Buys

Impulse purchases driven by marketing can lead to unnecessary spending. Taking time to evaluate your need for an item can curb these costly decisions and prevent buyer’s remorse.

High-Interest Credit Cards

High-interest credit cards can lead to hefty fees and interest payments. Switching to a card with a lower interest rate or paying off your balance in full each month can save you a significant amount of money.

Loan Refinancing

Many overlook the advantage of refinancing their loans. Finding loans with lower interest rates and reduced fees can save you thousands over the life of a loan.

Unused Memberships

Memberships for clubs or professional organizations can be a financial drain. Evaluate which memberships provide real value and cancel those that go unused or seem unnecessary.

Single-use items, from cleaning supplies to kitchen gadgets, can end up costing more over time. Opting for reusable alternatives can be a more sustainable and cost-effective choice in the long run.

Cashback Offers

Credit cards and apps offering cashback on purchases provide an easy way to save money. Taking advantage of these offers gives discounts on many everyday purchases.

Price Comparison

Not comparing prices before making a purchase can lead to overpaying. With many tools and apps available, spending a few extra minutes to find the best deals can result in substantial savings.

Smoking and Drinking

Smoking and drinking too much can hurt both your health and your wallet. These habits often lead to significant, ongoing costs, so cutting back or quitting can be a great way to improve both your well-being and your finances.