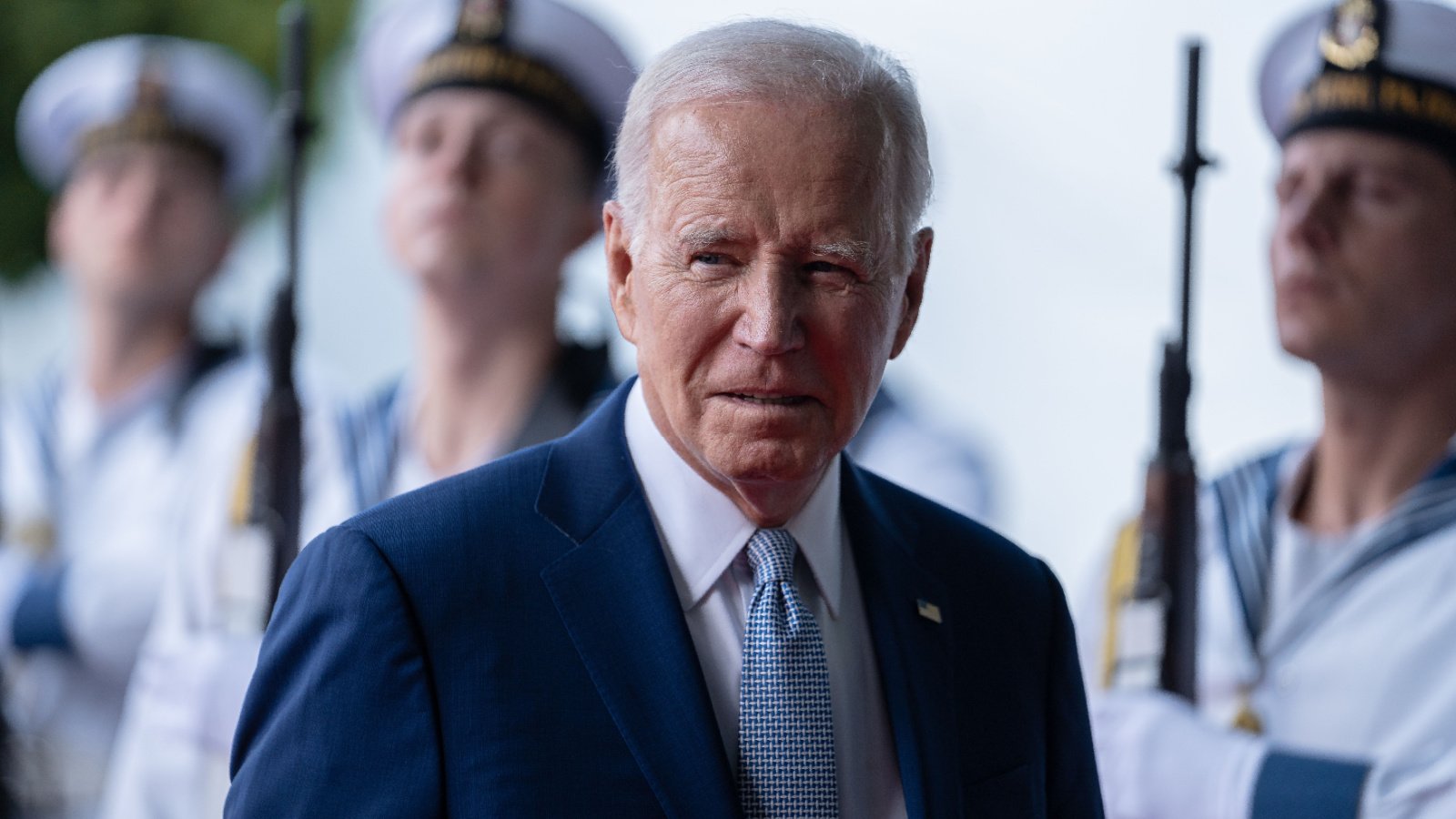

President Joe Biden recently announced a dedicated $6 billion for student loan repayment under the Public Service Loan Forgiveness Program. The White House has announced that the 78,000 borrowers eligible for immediate forgiveness will receive personal notification from the President via email next week.

The Beneficiaries: Public Service Workers

The policy change stands to benefit approximately 80,000 public service workers, including but not limited to teachers, nurses, and firefighters. These individuals, who have devoted their careers to serving their communities, will see their student loans forgiven, marking a significant relief in their financial obligations.

Enhancements to the Public Service Loan Forgiveness Program

This loan forgiveness is a part of the broader Public Service Loan Forgiveness (PSLF) program, which has recently been made more adaptable to meet the needs of public service workers. The adjustments aim to rectify previous administrative oversights that had prevented many eligible workers from receiving the financial relief they were entitled to.

Administration’s Commitment to Public Service Workers

The Biden administration’s statement emphasized the dedication of these public service workers and acknowledged the past failures that had barred them from achieving the loan forgiveness promised under the law. The recent fixes by the administration have significantly expanded the reach of the program, offering relief to a greater number of public service professionals.

A Comparison of Impact

The administration highlighted the dramatic increase in the number of public service workers benefiting from student debt forgiveness. Before these administrative adjustments, the number of public service borrowers who received forgiveness was roughly 7,000. Now, thanks to the recent changes, over 870,000 workers have had their student debts canceled.

The Scale of Government Efforts

This action is part of a larger government initiative to address student loan debt, which has now affected 3.6 million borrowers. The Biden administration has been proactive in seeking ways to reduce the financial burden of education, aiming to make higher education more accessible to all.

Notification Process for Eligible Borrowers

The White House has announced that the 78,000 borrowers eligible for immediate forgiveness will receive personal notification from the President via email next week. Additionally, thousands of other participants in the PSLF program will be informed if they are within two years of qualifying for their debt forgiveness.

Biden’s Ongoing Efforts to Reduce Student Debt

The recent loan forgiveness announcement is just one of several initiatives undertaken by President Biden in recent months aimed at either lowering or completely canceling student debt. This is part of his broader economic agenda, which he has been promoting across the country, focusing on reducing costs for Americans.

Educational Opportunities and Economic Growth

President Biden has been vocal about his administration’s goals from the outset, aiming to correct the flawed student loan systems and ensure that higher education serves as a conduit to middle-class success rather than a financial barrier.

A Comprehensive Economic Strategy

Biden’s approach to student debt relief is embedded in a wider economic vision. He seeks to construct an economy that expands by supporting the middle class and those working their way up from the bottom, ensuring that every American has the opportunity to succeed.

The Importance of Student Debt Relief

The administration’s efforts to forgive student debt underscore the importance of education in achieving economic prosperity. By removing the financial barriers to higher education, the government hopes to foster a more educated workforce that can contribute more significantly to the nation’s growth.

The Impact on Individual Lives

For the individuals receiving loan forgiveness, this policy change represents a life-altering shift. It alleviates the financial strain associated with higher education and opens up new opportunities for economic advancement and stability.

Opposition to Loan Forgiveness

Those opposed to Biden’s student loan forgiveness initiatives cite a variety of economic, philosophical, and fairness concerns. Conservatives often argue that widespread student loan forgiveness could have negative economic consequences, including increasing the national debt and potentially leading to higher inflation. They also express concern about the lack of fairness in the cost of such programs being passed onto taxpayers, including those who did not attend college or have already paid off their loans.

Personal Responsibility

Another often touted argument against student loan forgiveness programs is the importance of personal responsibility. Some may view taking out a student loan as a contractual agreement where the borrower agrees to repay the borrowed amount. Therefore, they argue that forgiving these loans undermines the concept of personal responsibility and accountability.

Setting a Precedent and Expectation for Future Loan Forgiveness

Finally, many opposed to loan forgiveness are concerned about setting a precedent for future behavior both from borrowers who might expect future debts to be forgiven and from institutions that might take riskier financial actions under the assumption of future bailouts.

Rather than loan forgiveness, many conservatives argue that efforts should focus on addressing the root causes of high college costs and exploring alternative forms of education and training that don’t require taking on significant debt.

Awesome post! Join the fun at https://www.web-kqc-whatsapp.com 藉助 WhatsApp 網頁版,能隨時使用快捷鍵,提高消息處理效率。 . Date: 2026-01-14 19:25:36 (-03).