Retirement in America is rife with financial hazards that often go unnoticed until it’s too late.

There are many common factors that deplete retirees’ bank accounts, ranging from the declining efficacy of Social Security to the rising cost of healthcare. Understanding these challenges is the first step toward effective retirement planning.

Here’s what to know about the most significant issues affecting American retirees today.

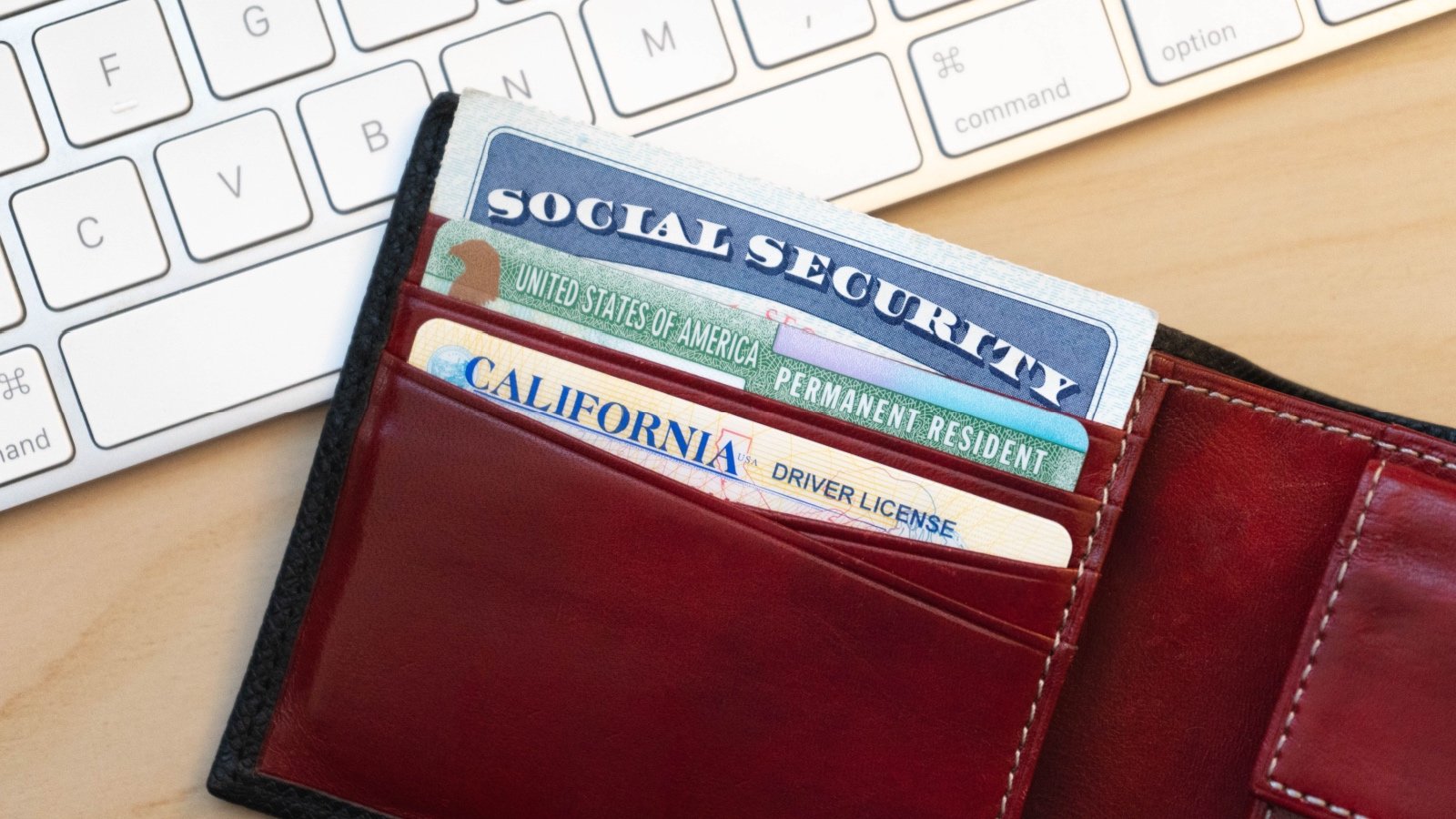

Social Security Shortfalls

The maximum Social Security benefit in 2024 is approximately $4,555 per month, but the average recipient receives much less. Due to inflation and cost-of-living adjustments lagging behind actual price increases, seniors often find their purchasing power decreasing each year.

Rising Healthcare Costs

Healthcare expenses for retirees are increasing at a rate faster than inflation, with projected lifetime costs for a retired couple exceeding $300,000 excluding long-term care. Medicare provides some relief, but it does not cover all medical expenses, such as hearing aids and most dental work.

Inadequate Pension Coverage

Only 17% of American workers have access to a traditional pension plan, down from 38% in 1980. Many companies have shifted to 401(k) plans, placing more responsibility on employees to manage their retirement savings. This shift leaves many retirees without sufficient lifelong income streams.

Dependency on 401(k) Savings

While 401(k) plans are a popular savings vehicle, they are subject to market volatility and require individuals to make complex investment decisions. The average 401(k) balance for Americans 65 and older is around $229,100, which may not sustain a long retirement.

Inflation Impact

Inflation erodes the value of saved money, making it harder for retirees to predict how much they will need. While the Federal Reserve aims for a 2% inflation rate, recent years have seen higher spikes. These increases strain retirees on fixed incomes.

Longevity Risk

Americans are living longer, with average life expectancy now exceeding 78 years. While this is a positive development, it increases the risk of outliving retirement savings. Financial planning for a retirement that may last 30 years or more requires precise strategies.

Housing Costs

Many retirees find themselves spending a significant portion of their income on housing, whether through mortgages or rent. Even those who own their homes outright may face escalating property taxes and maintenance costs. Such expenses can deplete retirement savings.

Lack of Financial Literacy

A lack of understanding about retirement planning can lead to inadequate savings and poor investment choices. Surveys show that only 33% of adults understand basic financial concepts like compound interest and inflation. This gap in knowledge poses a severe risk to seniors’ ability to plan for retirement.

Withdrawal Strategy Errors

Determining the optimal withdrawal rate from retirement savings is crucial and complex. If retirees withdraw too much too soon, they risk depleting their funds; too little, and they may unnecessarily constrain their lifestyle. Experts recommend a 4% withdrawal rate.

Social Isolation

Social isolation can have significant psychological and physical health impacts on retirees, potentially leading to increased healthcare costs. Studies link isolation to a 50% increased risk of developing dementia and other serious health conditions.

Elder Fraud

Financial scams targeting the elderly are on the rise, with losses estimated to be over $3 billion annually. Seniors are often targeted due to perceived vulnerabilities and sizable retirement savings. Awareness and education about common scams can help protect retirees’ assets.

Minimal Interest Rates on Savings

Persistently low interest rates have diminished the earning potential on safer investments like savings accounts and certificates of deposit. These low rates force retirees to either accept minimal growth or venture into riskier investments.

Tax Burdens

Retirees often overlook the tax implications of their retirement strategies. Withdrawals from traditional IRAs and 401(k)s are taxed as regular income, which can bump retirees into higher tax brackets. Effective tax planning must be an integral part of retirement planning.

Cognitive Decline

Cognitive abilities tend to decline with age, impacting financial decision-making. This natural deterioration can lead to poor investment choices or a failure to manage daily finances effectively. Setting up trusts or designating a financial power of attorney early can help.

Inadequate Insurance Coverage

Many retirees find that their insurance coverage is insufficient for their needs, particularly for unexpected illnesses or accidents. Long-term care insurance, for example, is often prohibitively expensive or unavailable to older adults. This gap in coverage can lead to significant out-of-pocket expenses.

Loss of a Spouse

The death of a spouse can have devastating financial implications in addition to emotional tolls. Often, income from Social Security or pensions decreases, while living expenses remain constant. Prepare for this eventuality through adequate savings and insurance policies.

Adjusting to Fixed Income

Adjusting to a fixed income can be challenging for retirees used to a steady paycheck. Budgeting becomes crucial, as fixed incomes may not keep pace with inflation or unexpected expenses. Financial advisors often recommend revising retirement budgets annually.

Lack of Part-Time Work Opportunities

Many retirees rely on part-time work to supplement their income, but suitable opportunities can be scarce. Age discrimination in hiring practices can limit job options for older adults. Policies promoting age diversity in the workplace could provide more opportunities for retirees.

Transportation Issues

As they age, retirees often face challenges in driving or accessing public transportation. This limitation affects their ability to maintain social connections, access services, and manage health care needs. Solutions like community shuttle services or ride-sharing options tailored for seniors can mitigate these difficulties but come at a cost.

Healthcare Availability

Access to quality healthcare becomes increasingly important as individuals age. In some regions, particularly rural areas, healthcare facilities are scarce or understaffed. This lack of accessibility can compromise retirees’ health.

Environmental Changes

Changing environmental conditions, such as increased heat waves or severe weather events, disproportionately affect older adults. These changes can lead to higher utility bills or property damage, straining retirees’ finances. Investing in energy-efficient home upgrades or community housing designed to withstand extreme weather can be beneficial long-term strategies.