The International Monetary Fund (IMF) issued a cautionary statement in April, stressing that while the U.S. is experiencing significant economic growth, the foundation of this growth might be unsustainable. The IMF’s concerns suggest potential risks to global economic stability if current fiscal policies are maintained.

The Link Between Fiscal Policy and Global Growth

In its latest World Economic Outlook, the IMF detailed how America’s notable economic performance has not only spurred global growth but is also deeply intertwined with high domestic demand and a fiscal policy that may not be sustainable in the long run. The report emphasizes the need for a reassessment of these policies to avoid adverse global economic impacts.

Warning of Potential Global Risks

The IMF report explicitly warned that the U.S.’s current fiscal approach, while beneficial in the short term, risks increasing global funding costs. This could lead to fiscal and financial stability issues on a worldwide scale, necessitating imminent policy adjustments.

U.S. Economy’s Growth Forecast

The IMF has revised its growth forecast for the U.S. economy upward to 2.7% for the year 2024, an increase of 0.6 percentage points from previous projections. This growth rate significantly surpasses that of other advanced economies, highlighting the unique position of the U.S. in the global economic landscape.

Insights from the Chief Economist

Pierre-Olivier Gourinchas, the IMF’s chief economist, shared insights in a blog post regarding the robust U.S. performance. He attributed this to significant gains in productivity and employment, but also to an economy that is currently overheated due to strong demand.

Recommended Monetary Policy Approach

Gourinchas advocated for a cautious and gradual approach to monetary easing by the Federal Reserve. He emphasized the importance of careful policy adjustments to prevent potential economic overheating and ensure sustainable growth.

Congressional Actions on Debt

In a move to manage the national budget more effectively, Congress voted last spring to suspend the debt limit until 2025. This was part of a broader bipartisan agreement that included budget caps aimed at curbing annual government spending.

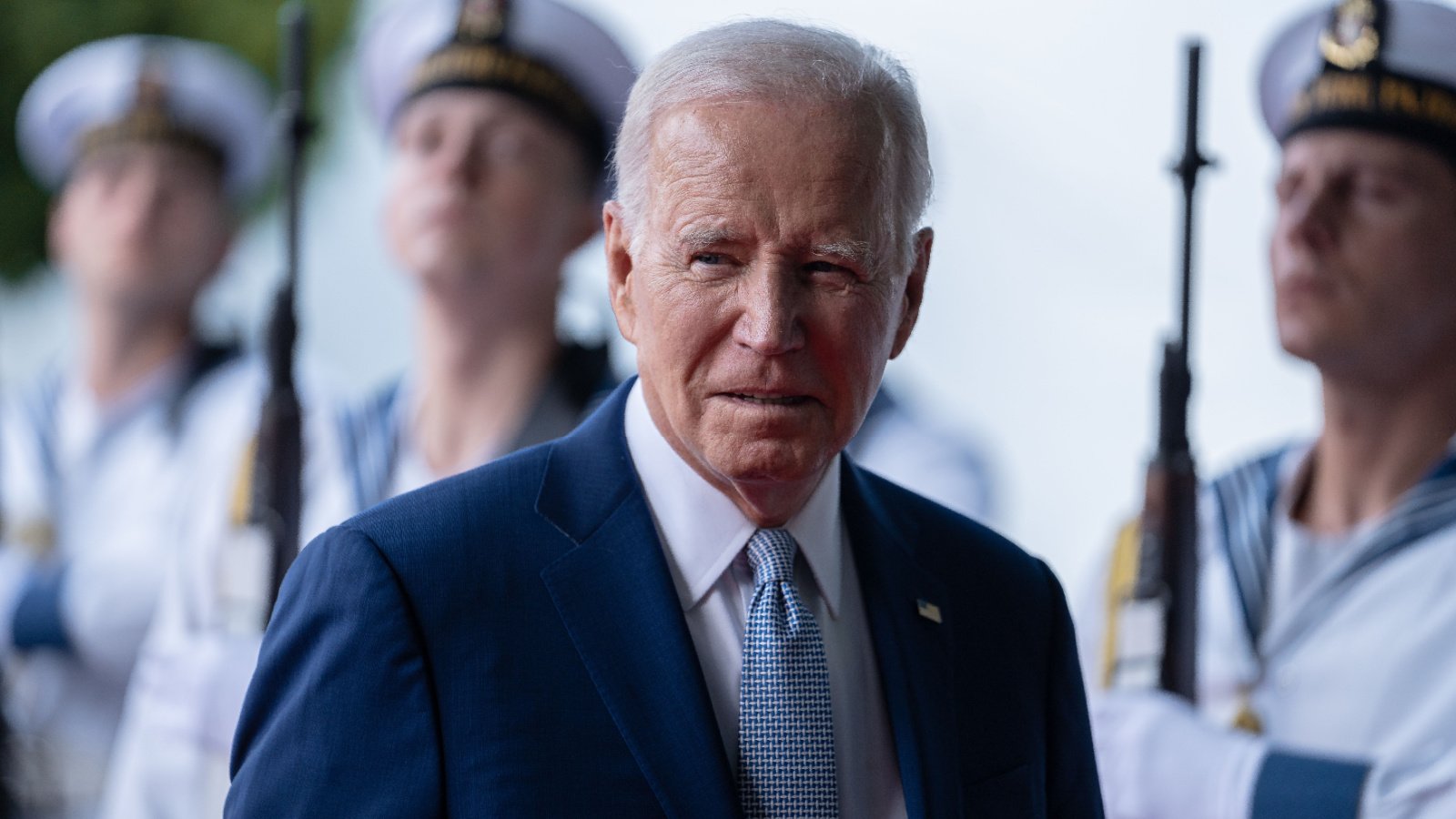

Biden Signed the “Fiscal Responsibility Act” in 2023

Legislation known as the “Fiscal Responsibility Act” was enacted after being approved by Congress and signed by President Joe Biden. This law raises the federal debt limit through 2025 while implementing spending caps for federal programs, maintaining them at fiscal year 2023 levels for 2024 and permitting only a modest 1% increase in 2025.

Additional Programs Affected by Fiscal Responsibility Act

Additionally, the act withdraws unutilized COVID-19 relief funds and introduces stricter work requirements for recipients of the Supplemental Nutrition Assistance Program (SNAP) and Temporary Assistance for Needy Families (TANF). The legislation also diverts funds initially allocated for IRS audits of wealthier taxpayers to other uses.

Current State of the National Debt

Following the suspension of the debt ceiling, the national debt, which was approximately $31.4 trillion at the time, has increased by several trillion dollars over the past year, according to data from the Treasury Department.

Long-term Economic Outlook

The Congressional Budget Office (CBO) released a report earlier this year predicting significant growth in the national deficit over the next 30 years. The report projects that the deficit will reach 8.5% of GDP by 2054.

Drivers Behind Deficit Growth

The CBO highlighted rising interest costs and large, sustained primary deficits as the main drivers behind the projected increase in the national deficit. These elements are expected to put considerable pressure on the economy if not addressed.

Implications for Future Policy

The forecast by the CBO underscores the urgency for policy reforms to address the escalating national debt and deficit levels. This will be crucial for maintaining economic stability and avoiding undue burden on future generations.

Global Economic Implications

The IMF’s warnings and the projections of the CBO both point to the interconnectedness of U.S. fiscal policy and global economic health. Changes in U.S. policy could have far-reaching effects, influencing global funding costs and economic stability.

Need for Policy Adjustment

The analysis presented by the IMF and the CBO makes it clear that adjustments in U.S. fiscal policy are necessary to ensure long-term economic sustainability. These adjustments will be vital to mitigate risks to both the U.S. and the global economy.

Conclusion

The IMF’s recent warnings and the U.S.’s economic forecasts highlight the critical need for sustainable fiscal policies. As the U.S. continues to play a significant role in global economic dynamics, the decisions made today will shape the economic landscape for decades to come.

Erfahren Sie, wie Scatter-Symbole und weitere Besonderheiten funktionieren, und testen Sie, auf welchen Einsatzstufen Sie das Spiel spielen wollen oder ob Sie

die Gewinnlinien ändern können. Casino Spiele kostenlos ohne Anmeldung zu

spielen und zu testen gibt Ihnen die Gelegenheit, unverbindlich und ohne Risiko

Ihre Vorlieben zu entdecken. Der Vorteil im Online Casino

ist, dass bei Online Slots und an den virtuellen Spieltischen die

Limits sehr niedrig sind, sodass Sie schon um geringe Summen spielen können.

Lernen Sie hier die verschiedenen Spiel-typen kennen, die Sie in Online Casinos spielen können.

In diesem Artikel stellen wir Ihnen die verschiedenen Aspekte vor, die ein bestes online casino ausmachen, einschließlich

casino spiele, casino bonus und vieles mehr. Haben Sie ein für Sie

besonders reizvolles Spiel gefunden, können Sie dann

eine erste Echtgeldeinzahlung vornehmen, sich den Willkommensbonus des Casinos

sichern und dann im Casino online spielen, mit Echtgeld.

Casino deutschland online bietet Spielern eine sichere Umgebung, in der sie spielen können, mit der Gewissheit,

dass ihre Rechte geschützt sind. Ein bester casino bonus kann

in verschiedenen Formen auftreten, einschließlich Einzahlungsboni, Freispielen und

Treueprogrammen.

Wir bieten dir immer wieder neue Spiele, für die sich immer mal

wieder ein Blick wirklich lohnt. Bislang konntest du das beliebteste

Automatenspiel der Novoline Serie nur in… Der Spielautomat Hammer of Gods

ist eine Anspielung auf die nordische Mythologie.

Der Spielautomat Carol of the Elves bietet uns eine tolle Weihnachtsatmosphäre.

References:

https://online-spielhallen.de/umfassende-sg-casino-erfahrungen-ein-spielerbericht-nach-10-jahren/

By far the biggest and most commonly found sites that offer prepaid cards are PaysafeCard casinos.

Alternatively, go to our database of free casino games, find the game

you wish to play, and click ‘Play for Real Money’.

There is now even the possibility to play live games

streamed directly from Las Vegas and Atlantic City tables.

You can play live dealer table games, like live blackjack or roulette, and intricate game shows.

You will find all the bonuses the casino offers and their Terms and Conditions,

which will help you choose the best offer. They are often targeted at certain games or game

types and usually consist of a time period and leaderboard for players to rise

through.

Online casinos in Australia offer a diverse and exciting range of

gaming options, from online pokies and blackjack to immersive live dealer games.

No deposit bonuses allow players to enjoy games without a deposit, offering a risk-free chance to explore the

casino’s offerings. Opt for the best online casinos offering a diverse range of games to keep things interesting.

Not every casino site loads perfectly in Australia, especially offshore ones.

The only catch is that most sites won’t let you withdraw

back to PayID, so you’ll need a backup option like crypto or bank transfer for

cashing out. It’s one of the fastest ways to move

AUD into your casino account, and it usually lands instantly.

Instead of typing in long bank details, you just send money using your email

or mobile number, simple as that. Some sites take Skrill but not Neteller, others the opposite.

These wallets make it easy to deposit and get paid quickly,

usually within a day or even sooner.

References:

https://blackcoin.co/treasury-casino-a-comprehensive-overview/

You won, mission accomplished, now it’s

time to withdraw. Whether you’re playing a positive progression (the

Paroli System) or a negative progression strategy (Martingale), you should always proceed with the utmost caution. Remember when I said I would give you my own gambling tips that my friends never

want to hear about? Their common point is that their game sessions per bet are

instant – you either win or lose. This will give you the best chance

of earning back the bonus. I wouldn’t suggest you play just to climb

the VIP ladder, but the VIP rewards come in handy along the way.

Lunubet has gained the trust of players all across

the nation and is considered the top Australian online casino,

despite only being there for under two years. Last but not least, we

also checked the mobile-friendliness of safe Aussie online casinos.

Naturally, our research largely focused on the safety and security of reputable online casinos in Australia.

The more of these, the merrier, but trusted online casinos

should never hit us too hard with terms and conditions.

Neospin was only formed in 2022, but it’s already

become the ultimate safe online casino Australia has to offer.

MrPacho is the safest online casino in Australia

if you’re looking to play pokies.

Yes, all of the recommended online casinos are legally available

if you are in Australia. Look for games with lower minimum bet requirements to get more spins and

rounds out of your current budget at the best Australian online casino.

If you are new to live gaming, choose classic table games with lower limits to get

familiar with the live interface and real-time pace.

Online real money casinos in Australia are known for

hosting video poker and casino poker.

References:

https://blackcoin.co/oaks-brisbane-casino-tower-suites-in-depth-review/

casino mit paypal

References:

https://udyogseba.com/employer/best-paypal-poker-sites/

online betting with paypal winnersbet

References:

jobsrific.com