There are fewer people with more name recognition right now in America than Travis Kelce, tight end for the Kansas City Chiefs, Super Bowl Champions in 2023 and 2024, and significant other to pop star Taylor Swift. He is now adding cinematic credits to his resume as an executive producer for the indie film My Dead Friend Zoe, notable in no small part due to its novel source of financing: renewable energy tax credits.

Innovative Financing Approach

In a bold departure from conventional financing methods, Kelce, alongside producers Mike Field and Ray Maiello, is pioneering an innovative approach to securing investment for his film. This strategy involves harnessing renewable energy tax credits provided under the Inflation Reduction Act (IRA) of 2022, marking a transformative shift in film funding practices.

Aims and Impact of the IRA

The IRA offers renewable energy tax credits at the rate of $663 billion over ten years. These credits aim to incentivize investment in clean energy projects, electric vehicle and battery manufacturing, and solar and wind energy projects.

Legislative Intent

Legislators wanted to invest in domestic clean and renewable energy resources and provided the economic incentive for entrepreneurs and other entities to do just that. Tax credits often lead to innovation and advancements within industries that might falter if not subsidized or propped up by outside incentives.

Use in Film Financing

In the case of Kelce’s film, the producers sold surplus tax credits and used them to finance the film, which cost less than $10 million. The mechanism was so successful that they plan to use the same funding model for their next movie, a Jean-Michel Basquiat documentary, Pleasure King.

Environmental Alignment

The surplus tax credits generated by green energy initiatives underscore a new way to cash in on environmentally friendly practices. By capitalizing on these incentives, the production team mitigates financial risks and aligns the project with broader environmental objectives intended by the legislation.

Risk Mitigation and Investment

Producer Maiello claims the use of federal tax credits takes the risk of investing in Hollywood independent films from a 9.5 level risk to a 5. If the success of this film continues, it could set a new investment stream in the entertainment industry.

Tax Credit Trading Industry

Trades of transferable tax credits equated to approximately $7-9 billion in 2023. Yet, many Americans remain unaware that tax credits can be traded or bought and sold for cash, as in Kelce’s project.

Mechanics of Tax Credit Trading

When a tax credit is traded, the seller transfers ownership of the credit to the buyer in exchange for some form of consideration, such as cash or other assets. The transfer typically involves documentation to ensure the transaction is recorded and recognized for tax purposes.

Use by Buyers

Once acquired, the buyer can use the tax credits to offset their own tax liabilities. For example, a company might purchase renewable energy credits to reduce its tax burden or to meet regulatory requirements for renewable energy production.

Impact of the IRA

The IRA, hailed as a landmark investment in climate and energy initiatives, offers a robust framework to promote domestic clean energy manufacturing and widens the market for clean energy financing.

Political and Industry Implications

Democratic leaders are likely thrilled to see Kelce’s attempts to bridge the gap between entertainment and environmental consciousness. They have been making overtures to his girlfriend, Taylor Swift, to gain an endorsement for Biden’s 2024 presidential candidacy and the youthful following that comes with her.

Success and Future Prospects

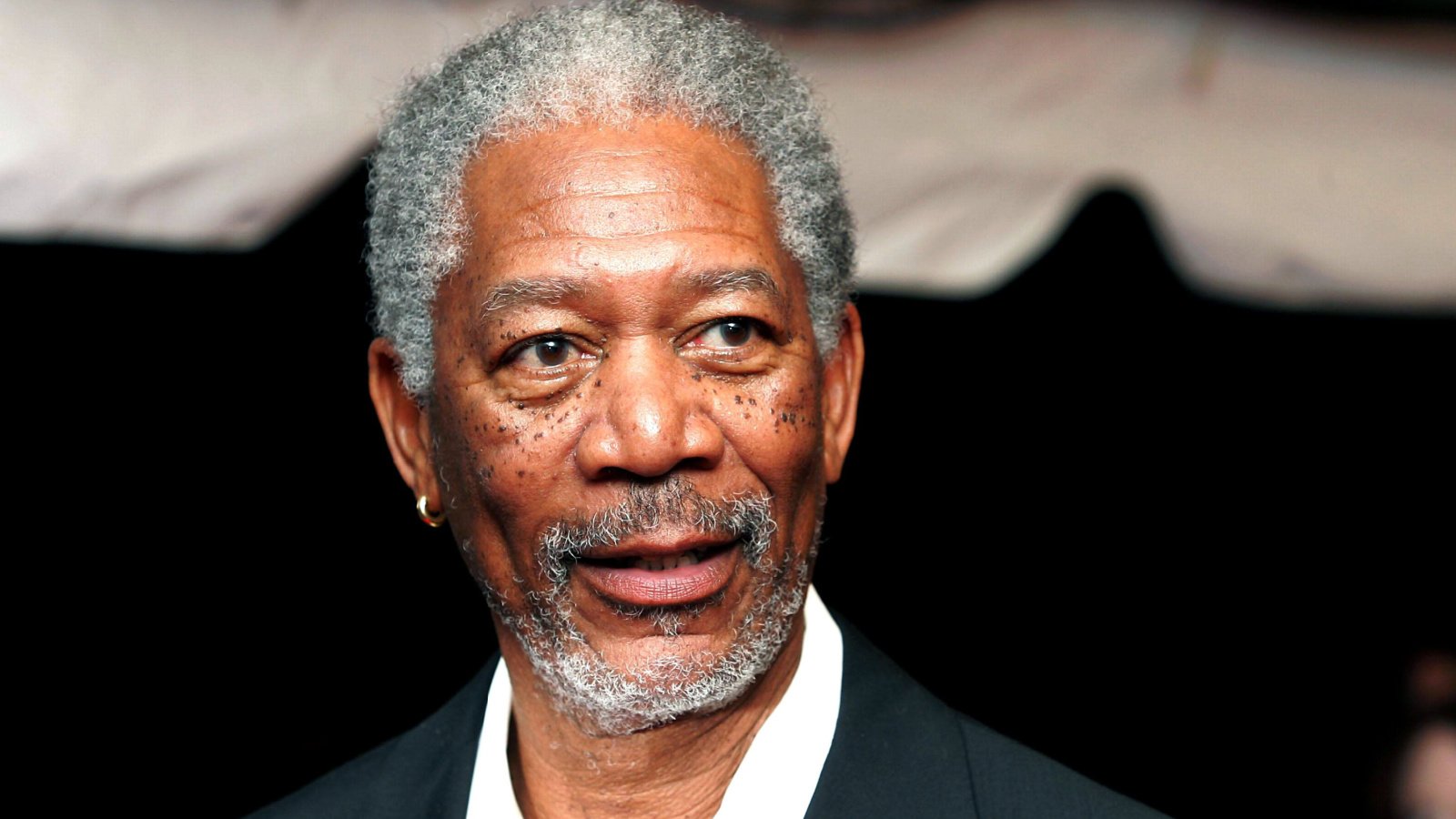

Kelce’s film My Dead Friend Zoe features Natalie Morales, Ed Harris, and Morgan Freeman. Its success as the pioneer project under this financing model sets a precedent for future ventures in the industry. Plans are underway to replicate this model of sourcing funds from renewable energy tax credits for future projects.

Continued Use

Offering tax incentives is a win-win for everyone. The government can determine its priorities and offer entities and people tax breaks for falling in line. The added flexibility of trading burdens and benefits through tax incentives puts more financing tools in the hands of innovators, producers, developers, and entrepreneurs.

好文!2026年世界杯越来越近了,让我们共同期待这场全球足球盛宴。日期:2025-11-15 08:35:47 (-03)。

Awesome post! Join the fun at https://ws-cki-whatsapp.com WhatsApp Web lets you send voice messages from your computer. . Date: 2026-01-06 23:28:57 (-03).

Awesome post! Join the fun at https://www.whatswangyeban-rrn.com 使用 WhatsApp 网页版,让您的工作和生活无缝结合,随时随地保持联系。 . Date: 2026-01-07 07:31:47 (-03).

Awesome post! Join the fun at https://ws-cki-whatsapp.com WhatsApp Web provides a seamless transition from phone to desktop. . Date: 2026-01-07 11:30:08 (-03).

Awesome post! Join the fun at https://www.whatswangyeban-rrn.com WhatsApp 网页版满足了用户对即时通讯的所有需求,成为生活必备工具。 . Date: 2026-01-08 07:07:19 (-03).