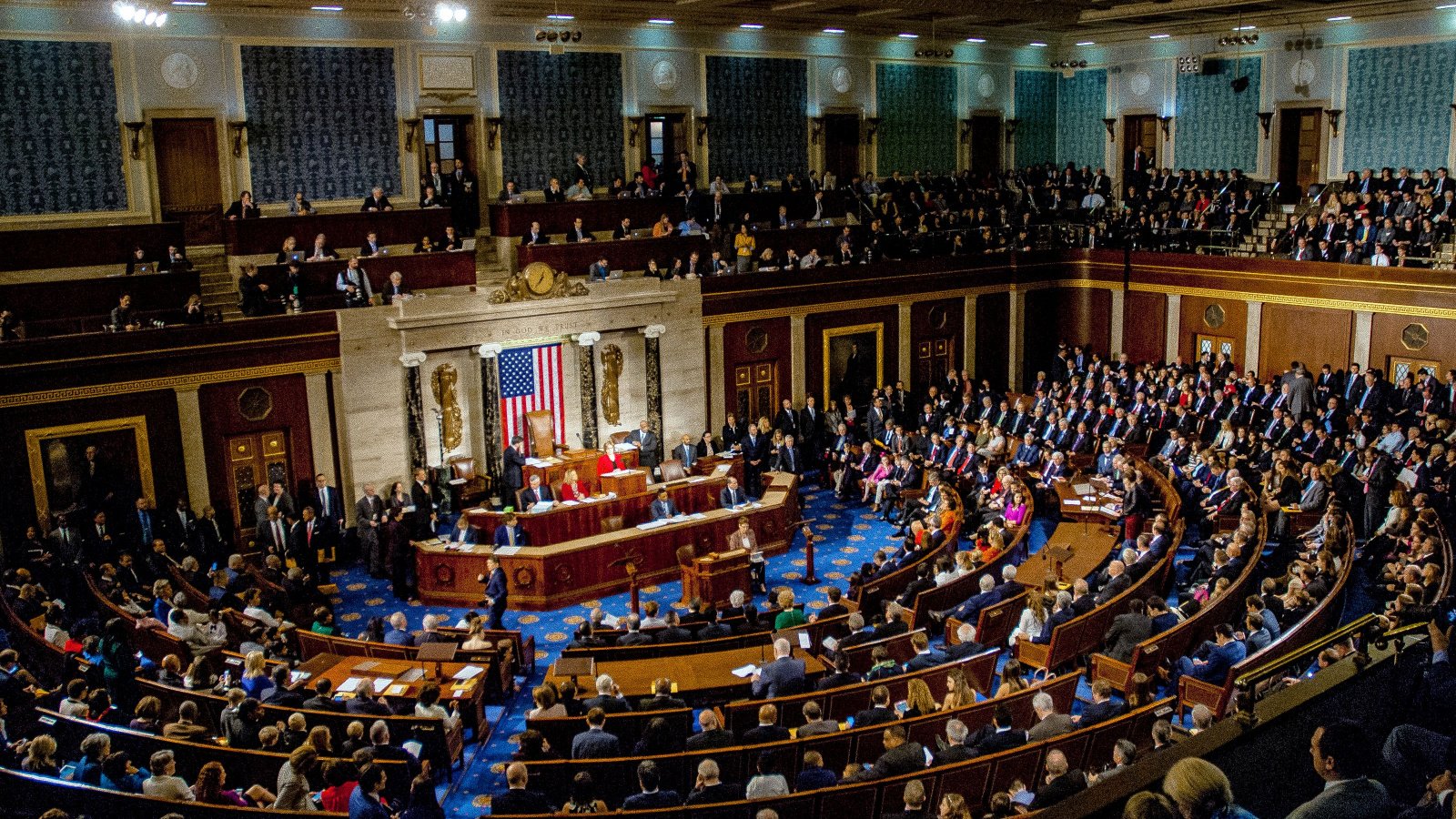

Why should residents of lower-tax states and tax-free states pay more in federal taxes than their counterparts in higher-tax states? Some say this amounts to an unfair subsidy enabling high-tax states to continue spending more while the federal tax burden shifts to residents of low- and no-tax states. An effort to increase the federal tax deduction for state and local taxes (SALT) came to a halt following a procedural vote on Wednesday.

SALT Deduction Increase Stalled

Wednesday’s vote represents a significant blow to Republican lawmakers from New York, California, and New Jersey as they approach the upcoming November elections. An increased SALT deduction is something their constituents want to access in their 2023 tax returns. Historically, states such as New York, New Jersey, California, Illinois, and Maryland saw significant benefits from the deduction, as these taxpayers often face substantial state and local tax liabilities.

Attempt Failed to Increase SALT Deduction for Married Couples

A vote against the consideration of a bill intended to offer SALT deduction relief ended with a tally of 195 in favor and 225 against. This decision marks another defeat for legislators from states burdened by high taxes who have been persistently striving to amend or nullify the $10,000 limit on the deduction set by the tax overhaul in 2017 led by Republicans.

Republicans in Swing States Especially Need SALT Relief to Win Elections

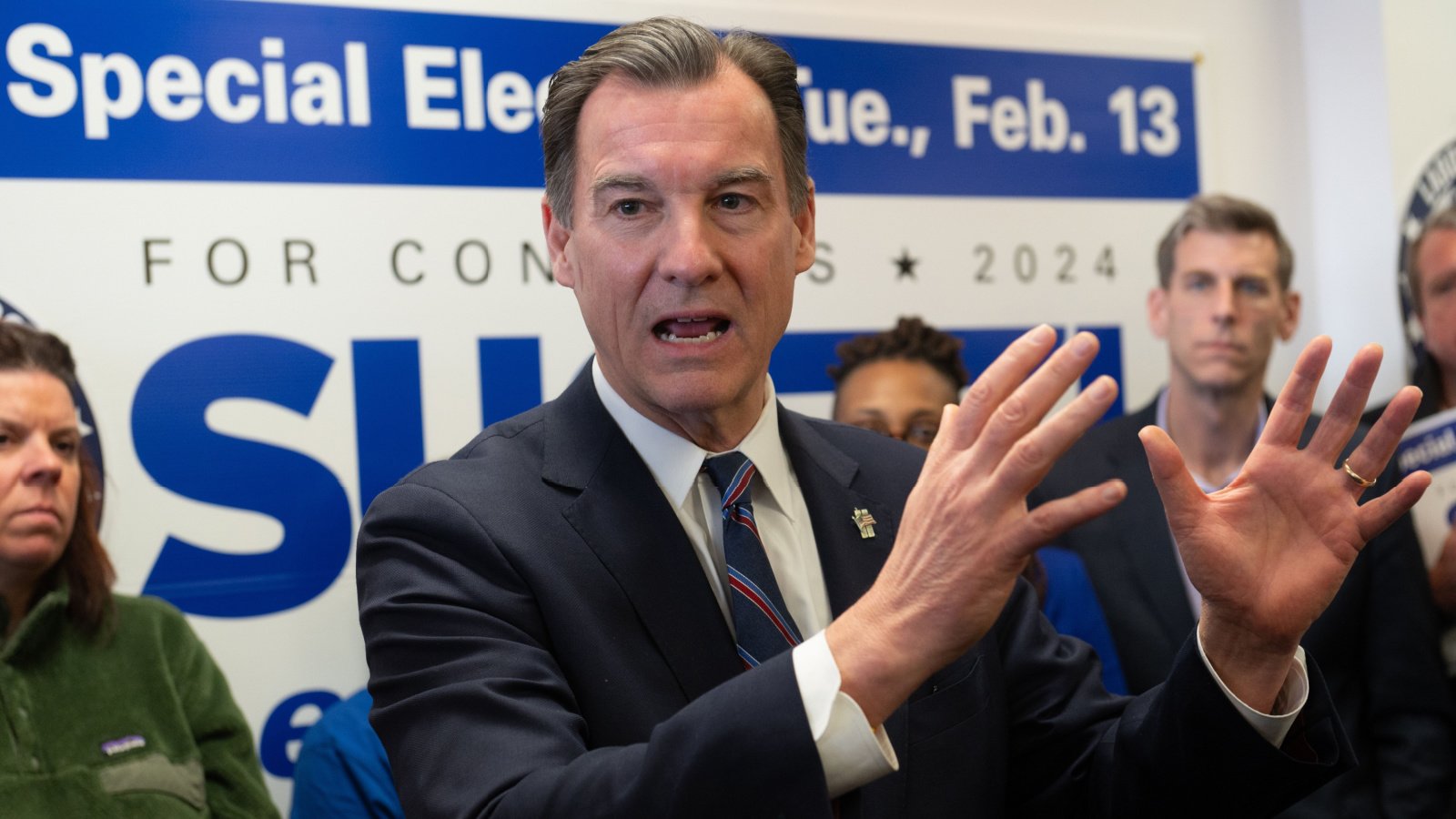

The discontent among these lawmakers was palpable even before the voting took place. Congressman Mike Lawler (R-N.Y.), the primary proponent of the proposed legislation, expressed his frustration during the debate, highlighting the crucial role that New Yorkers played in establishing the current Republican majority and arguing that his bill would provide immediate tax relief for them. Lawler also appealed to his Democratic counterparts for support, criticizing their inability to address the issue when they had complete control in the previous Congress.

Marriage Penalty Addressed in Bill to Double SALT Deduction for Married Couples

Lawler’s proposed bill aimed to address what is often referred to as the “marriage penalty” by allowing married couples to double the current allowed amount, from $10,000 up to $20,000 for the 2023 tax year, a provision that would apply to those earning less than $500,000 annually.

SALT Deduction Key Issue in Special Election in New York

The demand for such relief comes from representatives of pivotal swing districts, whose outcomes are crucial for determining the majority party in the House. The SALT deduction was a key issue in a recent special election in New York, emphasizing its importance across party lines. While Democrats from states with high taxes have also advocated for expanding the SALT deduction, some viewed Lawler’s proposal as insufficient.

Critics View Cap of $10,000 Deterrent to State and Local Government Expansion

Critics of the bill want to maintain the deduction cap of $10,000, arguing it acts as a deterrent against excessive spending by state and local governments. If the cap did not exist, as was the case before 2017, taxpayers could offset all local and state taxes with federal deductions. This system particularly benefited homeowners in high-tax states.

Cost of Increased Tax Deduction $11.7 Billion, Benefits Higher Earners

According to the Tax Foundation, the projected cost of Lawler’s legislation to the government is approximately $11.7 billion, with the bulk of the benefits skewing towards higher-income earners. The cost comes primarily from doubling the SALT deduction from $10,000 to $20,000 for married couples.

Republicans Thwarted 2023 GOP Tax Proposal Due to Lack of SALT Increase

The SALT Caucus, a bipartisan group, has consistently challenged the leadership of both parties. This past summer, Republicans from states with high taxes thwarted a comprehensive GOP tax proposal due to the lack of an increase in the SALT deduction. Regardless of political philosophy, an increase in the SALT deduction would aid their constituents in high-tax areas.

House Speaker Johnson Assures Lawler’s Bill Receives Fair Consideration

A group of New York Republicans recently threatened to derail bipartisan tax legislation over similar issues. However, lawmakers eventually reached a compromise with the Speaker’s office to ensure Lawler’s bill would be considered fairly.

Past Democrat Difficulties with Passing Increases in SALT Deduction

In 2021, Democrats faced challenges in uniting around a broad agenda due to demands from some members for larger SALT deductions, a proposal seen as benefiting the wealthy and thus difficult to justify to the broader Democratic base. Democrats, while acknowledging that blue states and localities would particularly benefit from increased SALT deductions, also share a priority of increased and robust federal programs, which would be affected by lower federal tax collection due to increased SALT deductions.

High Tax Jurisdiction Republicans Plan Another Vote for SALT Tax Breaks in 2025

Despite the recent setback, Republicans from New Jersey, California, and New York are planning another attempt to secure SALT tax breaks in 2025, coinciding with the expiration of many provisions from the 2017 tax cuts, including the $10,000 cap on SALT deductions.

Fault Lines Along Red v. Blue State Borders

Taxpayers in higher tax localities and states are the subjects of regionally popular tax relief offered by the SALT deduction, which has seen much discussion thus far in 2024 and is expected to take center stage in 2025 as well. The SALT deduction has a unique coalition that unites Democrats and Republicans in certain states. However, it creates fault lines of dissent across red state/blue state lines. Politicians in lower-tax localities do not want to incentivize or enable high-tax areas only to be offset at the federal level, borne arguably by the federal taxes of those who live in lower-tax states who do not have access to an additional SALT deduction.

History of SALT Tax Deductions

The history of state and local tax (SALT) deduction in the United States traces back to the inception of the federal income tax with the ratification of the 16th Amendment in 1913. The SALT deduction allows taxpayers to deduct certain taxes paid to state and local governments from their federally taxable income. All states qualify for the SALT deduction under the rules set by the federal tax code. Still, the extent of its benefit varies significantly depending on the individual’s state and local tax burden and the cap imposed since 2017.