From the insights and the regrets of those who learned the hard way, unveil financial faux pas that can derail your monetary stability. Each tale serves as a warning, guiding you through the danger zones of money management.

Ignoring Your Credit Score

Many people overlook their credit score, thinking it’s not crucial. However, a poor score can lead to high interest rates on loans, making purchases like homes or cars more expensive. Regularly checking your score can alert you to any discrepancies or fraudulent activities. Investing time in understanding and improving your credit score can save you thousands in the long run.

Not Having an Emergency Fund

Life is unpredictable, and not having an emergency fund can put you in a precarious financial situation. Without savings, unexpected expenses like medical bills or car repairs can force you into debt. Financial experts often recommend saving at least three to six months’ worth of living expenses. Starting an emergency fund, even if it’s small, can provide a safety net for life’s unexpected turns.

Living Beyond Your Means

Spending more than you earn is a surefire path to financial distress. Luxuries and non-essentials can quickly add up, leading to debt and financial stress. Setting a realistic budget and sticking to it ensures that you live within your means. Financial freedom comes from making conscious choices about spending and saving.

Falling for Get-Rich-Quick Schemes

The allure of quick money can be tempting, but these schemes often lead to more loss than gain. True wealth is built slowly through consistent saving and wise investments. Be wary of any investment that promises high returns with little risk. Educate yourself on financial matters, and remember, if it sounds too good to be true, it probably is.

Paying Only the Minimum on Credit Cards

Paying only the minimum on your credit card prolongs your debt and accrues massive interest. This habit can keep you in a cycle of debt, making it harder to achieve financial stability. Aim to pay more than the minimum each month or, better yet, pay off the full balance. This approach saves on interest and improves your credit score.

Not Investing in Your Future

Failing to plan for retirement can lead to a precarious financial future. The power of compound interest means that even small, regular contributions to a retirement account can grow significantly over time. Start investing early, and take advantage of any employer-matched retirement plans. Remember, your future self will thank you.

Neglecting Insurance

Skipping on insurance to save money can backfire catastrophically. Whether it’s health, home, or auto insurance, the right coverage can save you from financial ruin in case of an accident or emergency. Regularly review and adjust your coverage to ensure it meets your needs. Consider insurance as an investment in your and your family’s financial security.

Not Educating Yourself Financially

Financial illiteracy can lead to poor financial decisions and missed opportunities. The world of finance is complex, but understanding the basics is crucial. Take time to read books, attend workshops, or consult with a financial advisor. Knowledge is power, especially when it comes to managing your money.

Ignoring Debt

Ignoring your debt won’t make it disappear. In fact, it will only grow due to interest and late fees. Face your debt head-on by creating a payoff plan. Tackling your debt proactively can save you money and improve your financial well-being.

Falling for Impulse Purchases

Impulse buying, especially with easy online shopping, can sabotage your budget. These purchases might feel satisfying in the moment, but they often lead to buyer’s remorse and financial strain. Before making a purchase, ask yourself if it’s necessary and if it fits within your budget. Mindful spending can prevent unnecessary debt and save money.

Overlooking Tax Deductions

Failing to understand or claim all your eligible tax deductions can lead to overpaying taxes. Many people miss out on deductions for education, charitable donations, or home office expenses. Spend time understanding tax laws or consult with a tax professional. Properly managing your taxes can lead to significant savings.

Relying on One Source of Income

Depending solely on one income stream can be risky. Job loss or unexpected changes can leave you financially vulnerable. Consider diversifying your income through side jobs, investments, or a passive income source. Multiple income streams can provide financial security and peace of mind.

Ignoring Financial Goals

Without clear financial goals, it’s easy to wander aimlessly through financial decisions. Whether it’s saving for a home, investing, or paying off debt, having specific goals gives direction to your financial journey. Set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals and regularly review your progress. Focused efforts lead to significant achievements.

Neglecting to Negotiate Salary

Accepting the first salary offer without negotiation can lead to lost income potential. Research shows that failing to negotiate salary can cost you hundreds of thousands over your career. Understand your worth in the job market, and don’t be afraid to negotiate. Remember, your salary is the starting point for your financial growth.

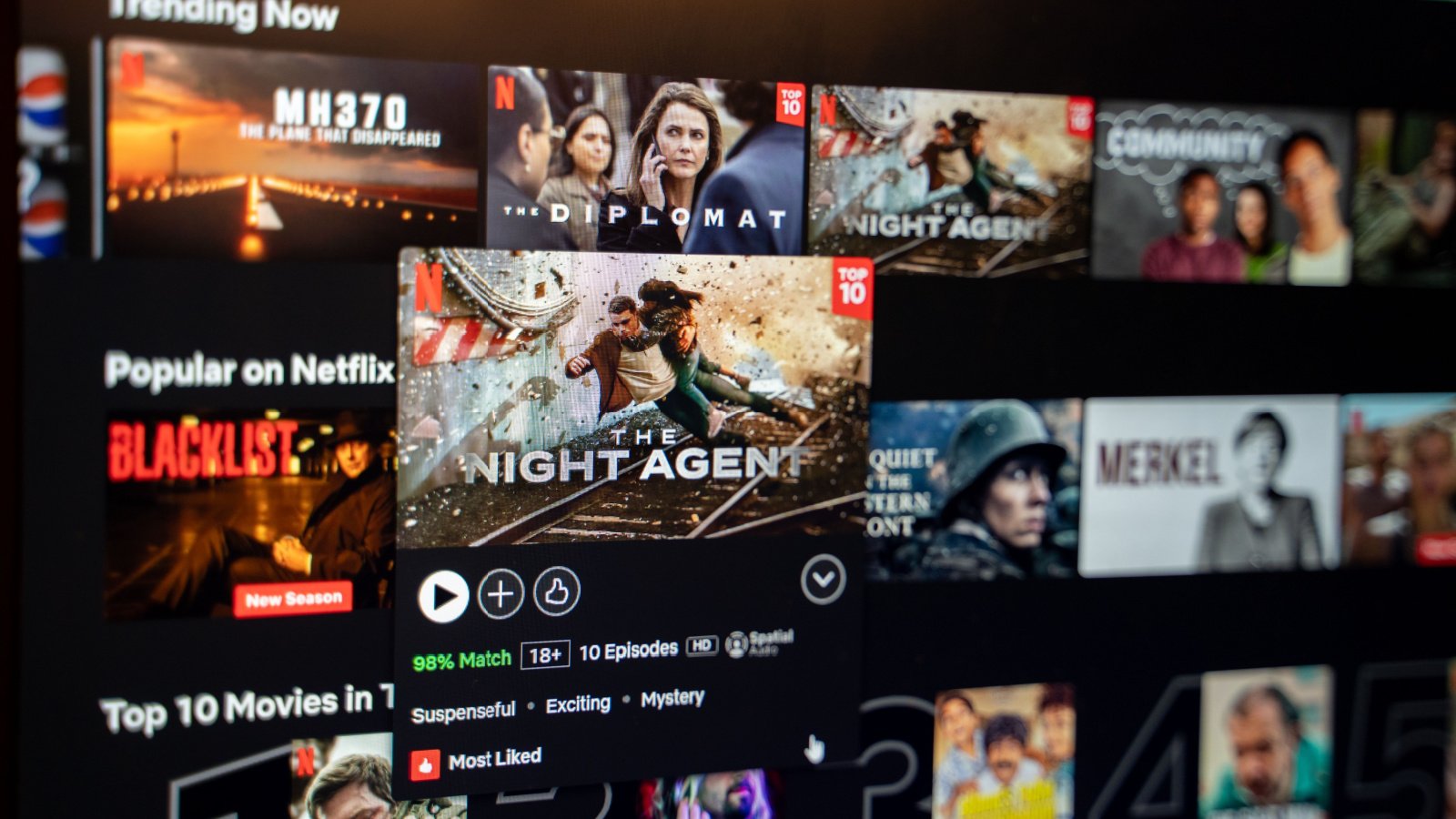

Failing to Monitor Your Subscriptions

Monthly subscriptions can drain your wallet without you even realizing it. Regularly review and evaluate your subscriptions. Cancel those you no longer use or find valuable. This simple habit can save you a considerable amount over time.

Investing Without Research

Putting money into investments without understanding them can lead to significant losses. Whether it’s stocks, real estate, or cryptocurrency, do your homework. Understand the risks and consult with financial advisors if needed. Informed investing is key to minimizing risk and maximizing returns.

Disregarding Maintenance Costs

Ignoring the maintenance of your property or possessions can lead to higher costs down the line. Regular maintenance can prevent small problems from becoming expensive disasters. Allocate a budget for the upkeep of your home, car, and other valuable possessions. Proactive maintenance can save you money and extend the life of your assets.

Falling Behind on Bills

Late payments can lead to late fees, higher interest rates, and a damaged credit score. Set up reminders or automate payments to ensure bills are paid on time. Staying on top of your bills not only saves money but also builds financial discipline. Remember, consistency is key to maintaining a healthy financial profile.

Not Shopping Around

Failing to compare prices or research before making a purchase can lead to overspending. Whether it’s insurance, services, or products, shopping around can save you a lot of money. Use comparison websites and read reviews to make informed decisions. Smart shopping can lead to significant savings without compromising on quality.

Mishandling a Windfall

Receiving a large sum of money, like an inheritance or bonus, can lead to impulsive spending. Without a plan, windfalls can disappear quickly. Treat any windfall as an opportunity to improve your financial situation—pay off debt, invest, or save. Thoughtful management of unexpected funds can secure your financial future.

Skipping Financial Checkups

Just like your health, your finances need regular checkups. Review your budget, investments, and financial goals periodically. Adjust your plan as necessary to stay on track. Regular financial checkups can help you catch issues early and keep your financial journey on course.