In the past, geopolitical events, natural disasters, and economic crises have all contributed to fluctuations in gas prices. Spikes in fuel costs have led to shifts in energy policies and consumer behavior. Let’s look back at significant times in history when gas prices soared and people panicked.

The 1973 Oil Crisis

In 1973, the Organization of Arab Petroleum Exporting Countries (OAPEC) declared an oil embargo against nations supporting Israel during the Yom Kippur War, causing global oil prices to quadruple. This embargo marked the first major spike in gas prices, leading to widespread fuel shortages and a reevaluation of energy policies in the United States and other Western countries.

Iranian Revolution 1979

The Iranian Revolution in 1979 dramatically disrupted oil exports from Iran, one of the world’s largest oil producers at the time. This political upheaval led to another significant spike in oil prices, doubling them and triggering economic recession and inflation in many countries. The effects of this crisis fundamentally altered the global economy and politics.

The 1990 Oil Price Shock

In August 1990, Iraq’s invasion of Kuwait set off a panic in oil markets due to fears of a massive oil supply disruption. Prices soared to levels not seen since the oil crisis of the 1970s, exacerbating an already developing economic downturn. This period underscored the world’s vulnerability to political instability in oil-rich regions.

Indian Ocean Earthquake and Tsunami 2004

The devastating Indian Ocean earthquake and tsunami in December 2004 disrupted oil production and transportation in the region, causing temporary increases in oil prices. This natural disaster demonstrated the global energy market’s sensitivity to regional disruptions. It also emphasized the need for international cooperation in disaster response and energy security.

Hurricane Katrina 2005

Hurricane Katrina, which struck the Gulf Coast of the United States in August 2005, damaged over 30 oil platforms and caused the closure of nine refineries; this resulted in substantial reductions in oil production. Gas prices surged as supply lines were disrupted, highlighting the fragility of oil infrastructure in natural disaster-prone areas.

Venezuelan Economic Crisis

Since 2005, the U.S. has imposed sanctions on Venezuela due to their ongoing economic and political crisis. This country has some of the largest oil reserves in the world, which has led to significant disruptions in its oil production and exports.

The Great Recession 2008

During the Great Recession, oil prices hit an all-time high of $147 per barrel in July 2008 due to high demand and market speculation. This spike was quickly followed by a sharp decline as the global economic downturn deepened, reducing demand for energy. The volatility of oil prices during this period led to widespread economic instability.

Libyan Civil War 2011

The outbreak of civil war in Libya in February 2011 slashed the country’s oil exports, causing crude prices to spike once again. Libya, a member of OPEC, had been a significant oil exporter, and the conflict disrupted global supply chains. This incident highlighted the ongoing risk of reliance on politically unstable countries for oil.

Iranian Sanctions 2012

In 2012, international sanctions imposed on Iran over its nuclear program severely cut the country’s oil exports, contributing to another worldwide increase in oil prices. These sanctions underscored the geopolitical dimensions of oil markets and their susceptibility to international policy and conflicts. The fluctuation in prices significantly impacted global economies.

Oil Price Surge 2018

In 2018, oil prices surged again due to prolonged OPEC-led production cuts combined with stable global demand, reaching a peak since 2014. This increase reflected ongoing tensions in the Middle East and production declines in Venezuela, another major oil producer. These dynamics demonstrated the continual challenges in balancing global oil supply with demand.

Saudi Drone Attacks 2019

In September 2019, drone attacks on Saudi Aramco oil facilities significantly reduced Saudi Arabia’s oil production, causing a temporary spike in global oil prices. The incident underscored the vulnerability of critical infrastructure and the potential for regional conflicts to impact global energy markets.

COVID-19 Pandemic 2020

Initially, during the COVID-19 pandemic, global oil demand plummeted, causing prices to drop. However, as economies began to recover and demand surged unexpectedly, oil production could not keep pace, leading to a significant increase in prices. This recent spike has underscored the challenges of predicting energy markets and the rapid impacts of global events on oil prices.

Arctic Cold Wave 2021

The severe Arctic cold wave in the United States in February 2021 led to significant disruptions in oil and gas production in Texas, a major energy-producing state. This unexpected event caused a spike in gas prices due to reduced supply and increased demand for heating. It highlighted the need for resilient infrastructure capable of withstanding extreme weather events.

Russian Invasion of Ukraine 2022

The Russian invasion of Ukraine in early 2022 led to international sanctions against Russia, one of the world’s largest oil producers, causing global oil prices to spike dramatically. This event not only disrupted supply but also led to fears of long-term energy shortages. The crisis has spurred countries to reconsider their energy dependency on Russia.

Post-2022 Recovery Fluctuations

As global economies struggled to recover from the COVID-19 pandemic, supply chain disruptions, and fluctuating demand patterns led to periodic spikes in oil prices. These fluctuations challenged economic planning and highlighted the ongoing need for robust energy policies. The recovery phase has been marked by efforts to stabilize energy markets.

North Sea Brent Field Decline

Discovered in 1971, the North Sea Brent oil fields have significantly contributed to fluctuations in oil prices over the decades. As one of the benchmarks for global oil pricing, changes in Brent production have widespread implications for global energy markets. The decline and eventual decommissioning prompted investment in other oil fields.

Shale Oil Boom and Bust Cycles

The rise of shale oil production in the United States initially led to a decrease in global oil prices due to increased supply. However, the boom-and-bust nature of shale oil, driven by fluctuating investment and production costs, has also caused periods of price volatility.

OPEC Production Quotas

Throughout history, OPEC’s decisions on production quotas have had significant impacts on global oil prices. For instance, agreements to cut production to stabilize prices have often led to short-term price spikes. Understanding OPEC’s influence is crucial for predicting and managing oil market dynamics.

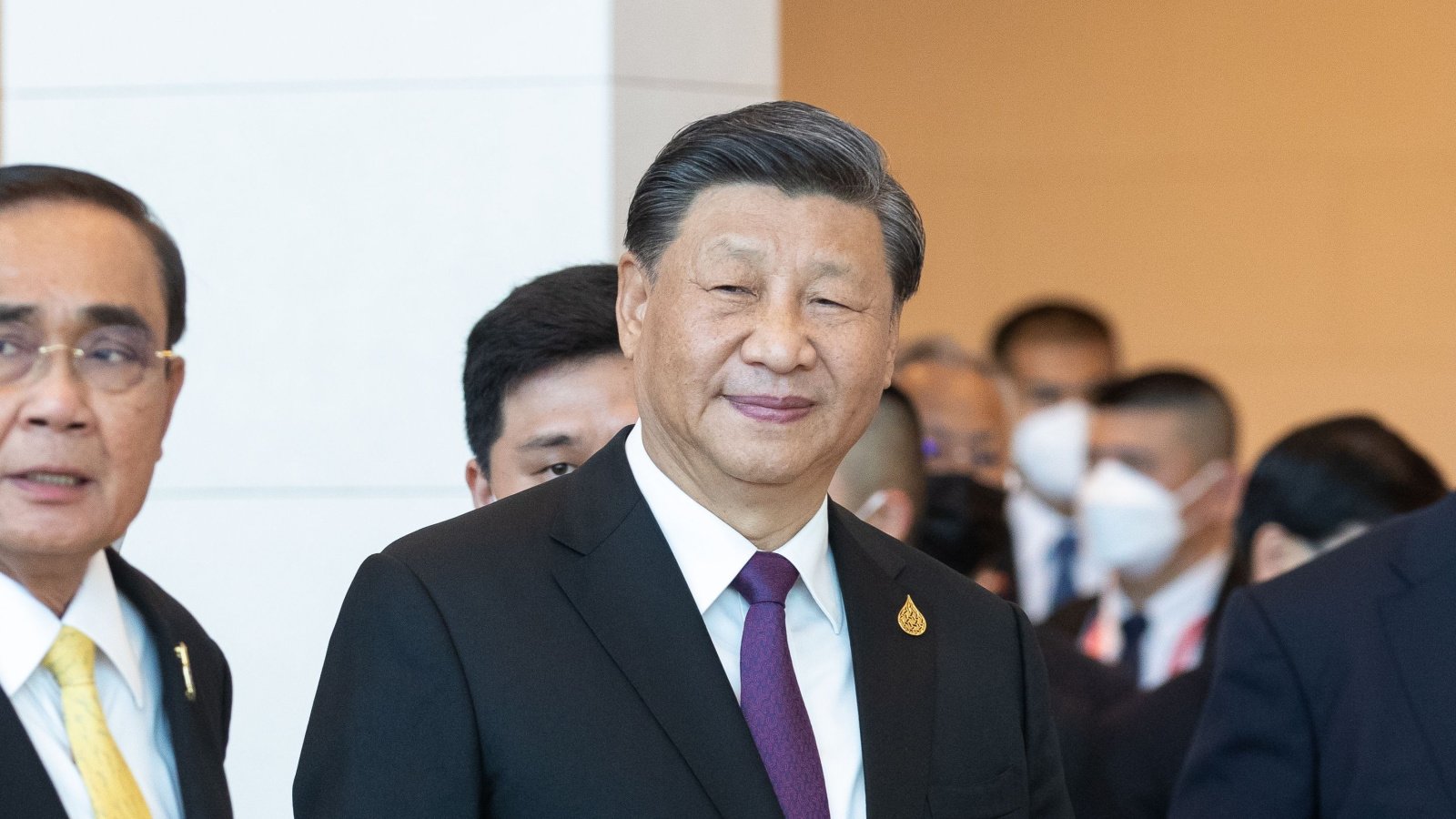

Chinese Demand Surge

China’s rapid industrialization and economic growth have led to significant increases in global oil demand, impacting prices. Periods of particularly high demand from China have caused price spikes as global supply struggled to keep pace. Understanding China’s role in the global energy market is essential for anticipating future price trends.

Middle East Tensions

Ongoing political tensions and conflicts in the Middle East, a region with some of the world’s largest oil reserves, have repeatedly caused oil price spikes. Events such as the Gulf Wars and recent tensions with Iran have led to concerns over supply disruptions. These geopolitical factors continue to play a critical role in global oil price stability and market forecasts.

Historical Trends and Future Concerns

Historical analysis shows that spikes in oil prices often follow geopolitical unrest, natural disasters, and sudden economic changes. These events serve as important lessons for diversifying energy sources and enhancing strategic petroleum reserves. Looking forward, energy security will likely continue to be a pivotal element in global economic stability and policymaking.

CoinCasino ist in Anjouan lizenziert und bietet Krypto Sicherheit und Offenheit.

CoinCasino und TG.Casino bieten sogar Telegram Wetten an und funktionieren gut

auf Smartphones. Viele gute 1€ Casinos bieten großartiges mobiles Spielen, auch

ohne native Apps. Jackpoty Casinos Freispiele sind zwar auf bestimmte

Slots beschränkt, aber dennoch hervorragend. Jackpoty punktet

ebenfalls, denn dieses Top Casino akzeptiert Bargeld und

Krypto ohne Gebühren, ab einem Mindestbetrag von 10 €.

Abschließend lässt sich sagen, dass dir Echtgeld Online Casinos im

Jahr 2025 viele Vorteile bieten. Hier erfährst du, welche Spiele du legal um echtes Geld spielen kannst und welche Auswirkungen die Regulierung auf die

Vielfalt hat. Profitiere von Freispielen, die dir kostenlose Runden an Spielautomaten mit echten Gewinnchancen ermöglichen – ideal, um neue Slots zu testen. Oftmals erhältst du diesen als Match-Bonus auf

deine erste Einzahlung, kombiniert mit zusätzlichen Freispielen. Der Willkommensbonus ist ein Startgeschenk im Echtgeld Online Casino.

Diese Vorgaben sorgen für ein hohes Maß an Sicherheit und Transparenz in lizenzierten deutschen Echtgeld Casinos.

References:

https://online-spielhallen.de/die-9-besten-online-casinos-deutschland-2025-top-guide/

They could have more welcome and returning player bonuses (the best casinos offer at least 7).

Our casino bonuses are designed with fair bonus terms, ensuring players can maximize their gameplay

value without excessive restrictions. Regular players enjoy reload

bonuses, cashback offers, and exclusive promotions.

The best games to play with a RocketPlay Casino Bonus depend

on the type of bonus you claim. Bonuses help players enjoy more

games with extra funds. Some bonuses require deposits, while others don’t.

If you are a regular player, reload and loyalty

bonuses keep you engaged. Casino bonuses make

online gambling more exciting.

Get a huge 200% bonus up to 200 AUD and 100 Free Spins on your first deposit –

play for real money on pokies and live casino games.

New or existing casino players are often offered deposit bonus in exchange for depositing real

money into their casino account. Australian players have many online casinos

to choose from, but RocketPlay offers something distinct with its regional support and tailored offerings.

Offering a no deposit free spins bonus is a great way for casinos to help players get familiar with a slot.

New players at Sky Vegas can claim 50 FREE

SPINS with no deposit required when joining one of the UK’s

top online casinos today! For players based in the UK, there’s no doubt that Sky Vegas currently offers a great no deposit bonus.

References:

https://blackcoin.co/bay-101-casino-in-depth-review/

As a new player at Winspirit Casino, you can receive a lucrative Welcome

Package that includes bonuses for your initial

deposits. Winspirit Casino is constantly striving to increase the level of enjoyment

of its players, and one of the ways to achieve this is

through regular weekly bonuses. The support team will

help resolve winspirit bonus code issues.

Can I win real money with winspirit online casino games?

The platform’s curated lists help players explore recommended pokie picks by provider

and theme. The platform aims for transparent limits and clear processing timeframes to deliver a reliable user

experience. WinSpirit supports a broad set of payment methods

suitable for Australian players. The sign-up flow is mobile-friendly and mirrors the desktop experience available

via the WinSpirit casino app or web PWA. The site—often called winspirit or ws casino—combines a wide game catalogue

with flexible banking and a strong mobile offering.

Deposit A$1,000 and you’ll see A$3,000 in your account – A$1,000

real cash plus A$2,000 bonus funds. Local progressives tied to single games

often look impressive but reset so frequently they’re basically

dressed-up regular slots with fancy counters. Mobile gaming separates

the wheat from the chaff, and WinSpirit’s app doesn’t mess around.

Over 3,000 slots sprawl across your screen, powered by 60+

providers that range from household names to hidden gems

most Aussie casinos wouldn’t touch with a ten-foot pole.

online casino mit paypal einzahlung

References:

http://www.ttceducation.co.kr

us poker sites that accept paypal

References:

https://externalliancerh.com/employer/paypal-online-casinos-best-us-casinos-accepting-paypal-payment-method/