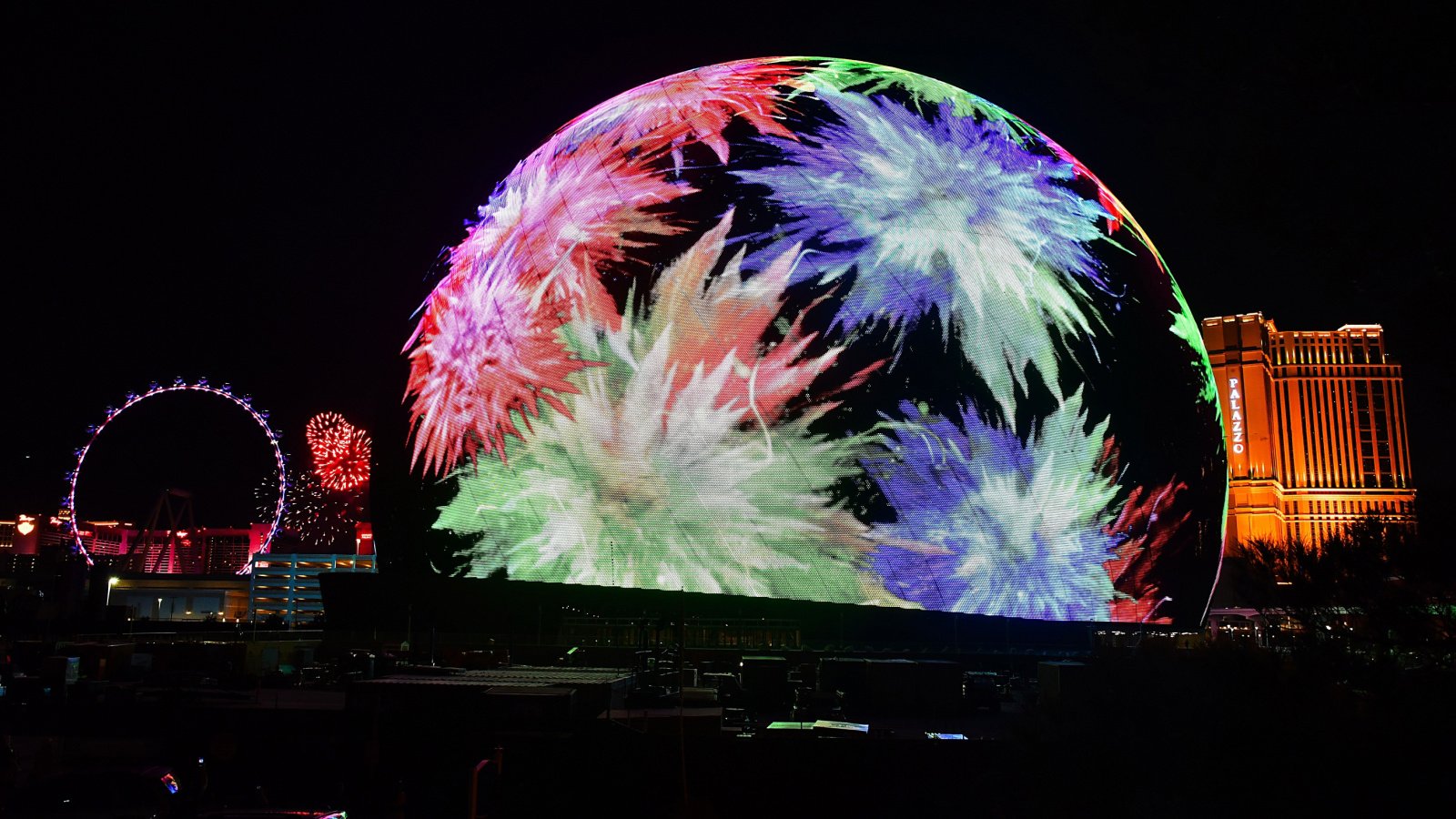

Brightline, a modern rail company, is charging ahead with plans to revolutionize travel in the United States with high-speed trains. Their next ambitious project, Brightline West, is a $12-billion plan to forge a 218-mile rail link between Las Vegas and Rancho Cucamonga, marking it as the nation’s first true high-speed rail endeavor.

A Race Against Time

Brightline’s team is aiming for a top speed of 200 mph, targeting a grand unveiling by 2028, just in time to welcome the Los Angeles Olympics, but they need things to move steadily forward to break ground this spring, and stay on target.

A Financial Boost

The Biden administration is throwing its weight behind this trailblazing private project, earmarking $3 billion in federal funds alongside eligibility for $3.5 billion in tax-exempt bonds. This robust financial support is not just about funding; it’s a statement of faith in private sector to deliver where public high-speed rail projects have previously stumbled.

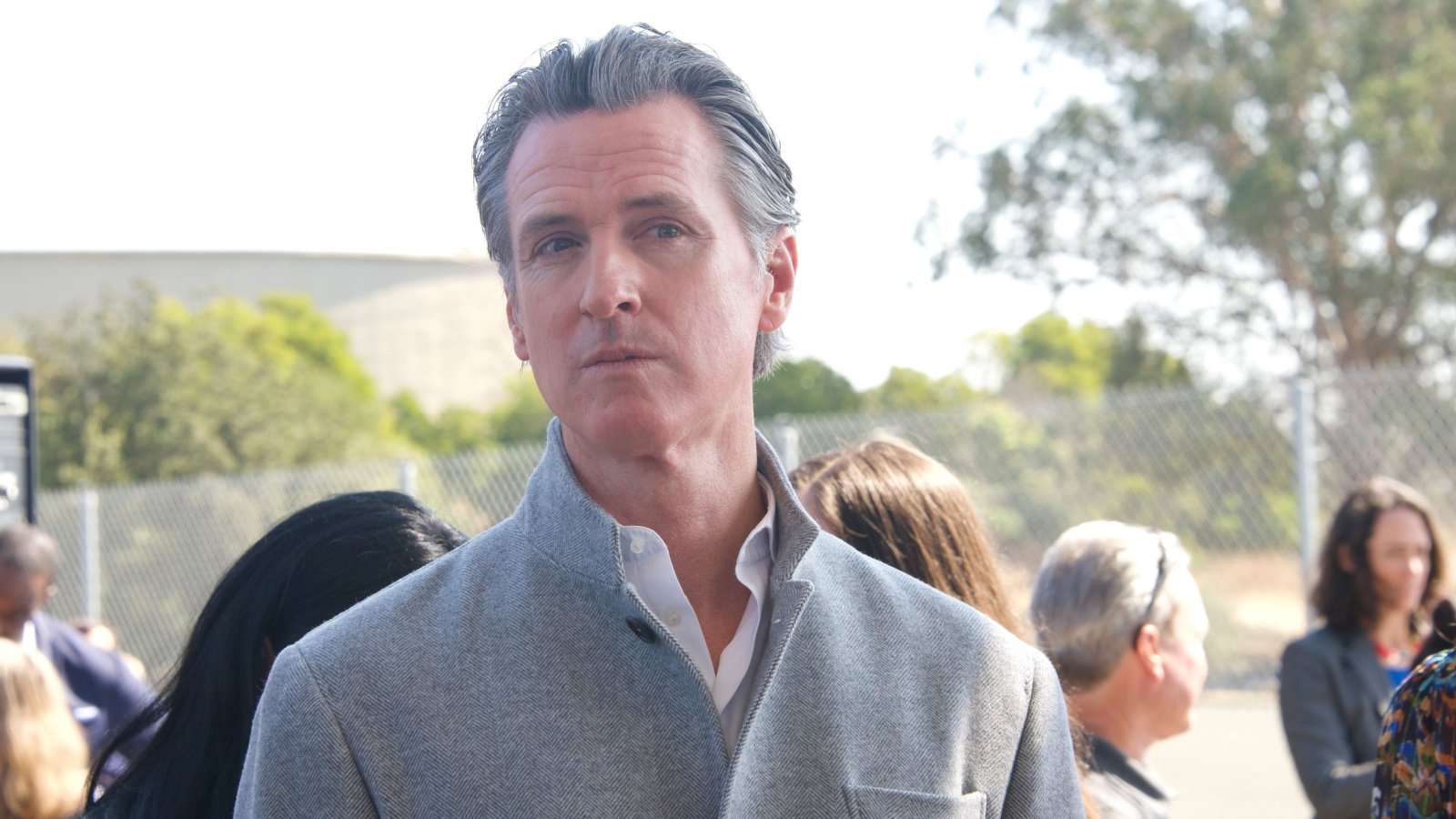

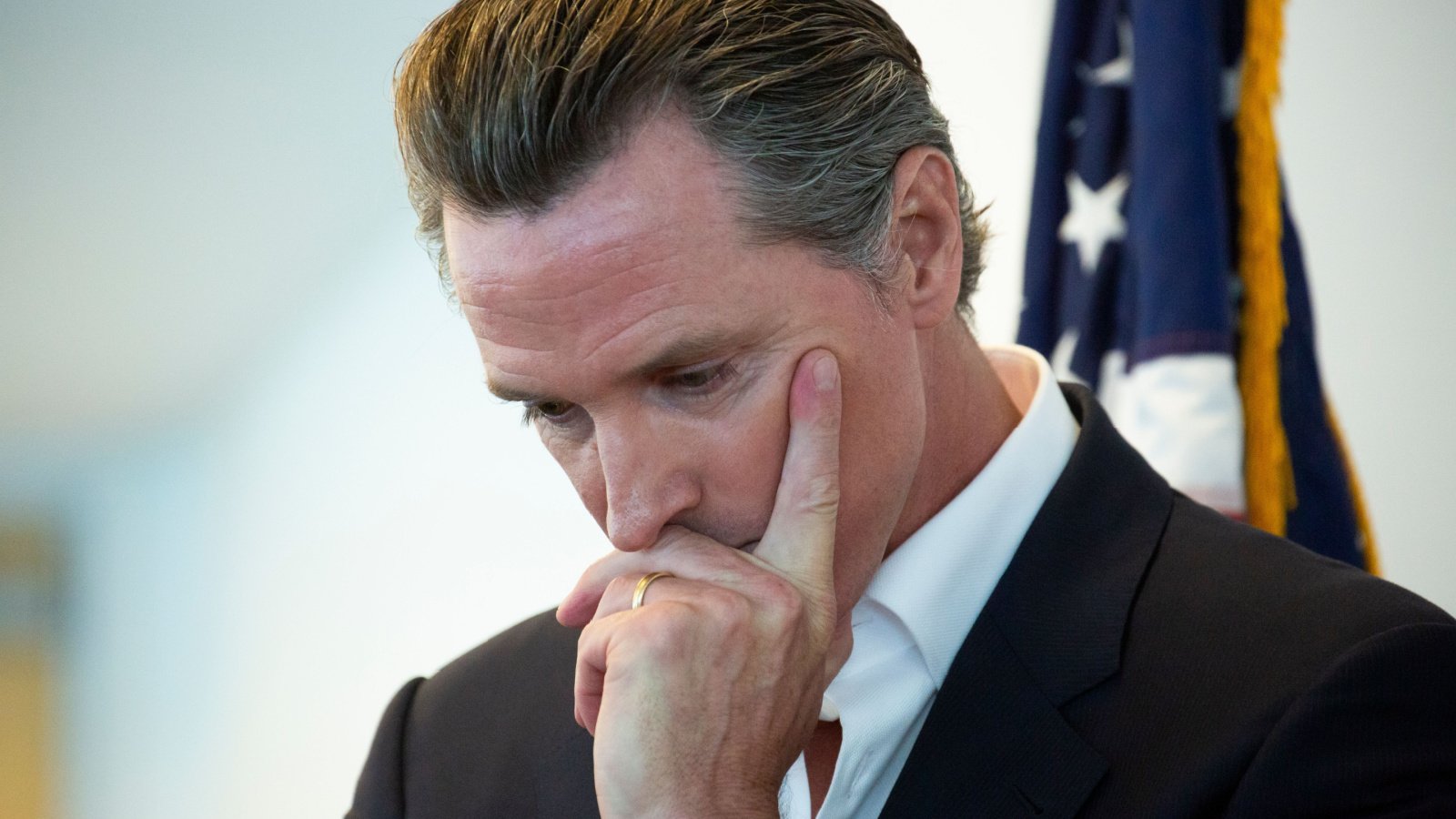

California’s Rail Reality Check

Pitched to voters in 2008 as a sleek bullet train to bridge Los Angeles and San Francisco, California’s high-speed rail dream has since encountered bumpy tracks. The forecast, once pegged at $40 billion, has ballooned over recent years.

Budget Burdens and Skeptical Voices

Completing the envisioned rail line now demands an additional $100 billion, a figure that far exceeds initial budgetary estimates. This hefty price tag has drawn sharp criticism, particularly from Republican State Senate Minority Leader Brian Jones, who bluntly doubts the project’s completion, pointing to the daunting $100 billion financial gap.

Jones Calls for Cancellation

Amid escalating costs and mounting skepticism, Brian Jones has become a vocal opponent, advocating for the project’s termination. His stance underscores a broader skepticism and raises questions about the future viability of California’s ambitious high-speed rail endeavor.

Weighing the Cost

As the price tag of California’s high-speed rail project skyrockets, critics like Brian Jones argue that the $18 billion already spent amounts to nothing short of financial folly. This perspective calls for a hard look at whether the escalating costs can ever justify the project’s continuation.

In Search of Solid Ground

Despite the financial questions, Brian Kelly, CEO of the California High-Speed Rail Authority, hasn’t lost hope. He’s on a mission to drum up additional support from both the federal government and private sector, believing steadfastly in the project’s feasibility.

Kelly Pledges for Progress

Kelly is also making a direct appeal to the public, underscoring the project’s ongoing improvements and potential benefits. He’s confident that better performance today signals a brighter future for the high-speed rail, aiming to sway both public opinion and stakeholder confidence.

The Debate Over Dollars

The allocation of massive funds towards the rail project has ignited a fierce debate about fiscal priorities in California. Critics argue that such an investment diverts essential resources from critical areas like education, housing, and mental health care, questioning whether the state’s financial priorities align with its residents’ needs.

Financial Frustrations Mount

As California’s bullet train financial estimates spiral from $40 billion to over $135 billion, the project’s fiscal management—or lack thereof—has come under intense scrutiny. This stark escalation forces a reconsideration of whether the investment remains justified amidst ballooning costs.

The Path Forward For Brightline West

Brightline West distinguishes itself as the trailblazer among high-speed rail projects in the U.S., boasting comprehensive labor agreements, secured right-of-way access, and all necessary environmental clearances. This readiness sets it apart from public ventures like California’s high-speed rail, which has been tangled in bureaucratic hurdles.

Addressing Historical Headwinds

Despite Brightline West’s promising start, experts maintain a healthy skepticism, mindful of the traditional barriers that have derailed high-speed rail ambitions in the States. Challenges range from widespread suburban layouts and highway-centric urban planning to Americans’ entrenched love for their cars, compounded by unyielding labor laws and rail infrastructure woes.

Capturing a Captive Audience

The potential to convert the 50 million yearly voyagers trekking between Southern California and Las Vegas from road to rail underpins Brightline West’s vision. Edens imagines a future where frustrated drivers, gridlocked and going nowhere, gaze enviously at Brightline trains gliding past at breathtaking speeds, presenting an irresistible travel alternative.

Florida’s Financial Headwinds

Brightline’s Floridian venture, launched with high hopes in 2018, has struggled to attract the anticipated ridership. Financial reports reveal a concerning $190 million operating loss in just the first three quarters of the last year, underscoring the uphill battle as it extends its reach across Miami, Fort Lauderdale, and West Palm Beach.

Challenges Beyond the Horizon

Brightline West, while ambitious, is confronted with its own unique set of hurdles. The route’s steep gradients and the terminal’s location in Rancho Cucamonga, a considerable distance from downtown Los Angeles, present logistical dilemmas. These challenges complicate the journey for travelers, potentially dampening enthusiasm for the rail alternative.

Pricing and Accessibility Concerns

With potential round-trip fares soaring above $400, Brightline’s vision of high-speed rail may clash with the reality of consumer affordability. This pricing strategy risks alienating a broad swath of potential users, highlighting the tension between ambitious infrastructure projects and their practical impact on everyday travelers.

Debate Over Best Use of Assets

Brightline’s approach in Florida, leveraging substantial real estate assets for funding, underscores the pivotal role of land development in the rail sector. The fate of extensive land holdings in Victor Valley and near the Las Vegas station is yet to be determined, but their strategic utilization could be key to Brightline West’s viability and success.

Wir berücksichtigen verschiedene Kriterien wie Boni,

Zahlungsmethoden, die Auswahl an Spielen und die allgemeine Benutzererfahrung,

um Ihnen eine detaillierte Übersicht zu bieten. Einige bieten bessere Bonusangebote, eine größere Auswahl an Spielen oder schnellere Auszahlungszeiten. Im Jahr 2025

haben sich viele Online-Casinos in Deutschland dazu entschieden,

Paysafecard als Zahlungsmethode anzubieten. In den nächsten Abschnitten werden wir Ihnen die besten Casinos vorstellen, die diese

Zahlungsmethode anbieten, sowie die Vor- und Nachteile von Paysafecard im Online-Casino-Spielerlebnis erläutern.

Besonders attraktiv sind die casino bonus, paysafecard casino bonus und casino

paysafecard bonus Angebote sowie exklusive bonus crab Aktionen, die regelmäßig für zusätzliche Anreize sorgen. Es gibt attraktive casino bonus, paysafecard casino bonus und casino paysafecard bonus

Angebote sowie exklusive bonus crab Aktionen, die sowohl für neue Spieler

als auch für Bestandskunden zusätzliche Anreize schaffen. JackpotPiraten gilt als top casino und gehört zu den beliebtesten Online-Casinos in Deutschland,

das eine breite Auswahl an games wie Spielautomaten, Tischspielen, jackpot spiele und live dealer games bietet.

Die Spielcasinos in Mecklenburg-Vorpommern bieten, wie

auch andere Bundesländer, bereits mit der ersten Einzahlung

einen Willkommensbonus an. DrückGlück gilt als top casino und ist ein weiteres populäres

Online-Casino, das mit einer Vielzahl von Spielautomaten und Tischspielen überzeugt.

Die Spielbanken mit Konzession B dürfen nur drei

Arten von Tischspielen (z. B. Roulette, Black Jack und Poker) und höchstens 250

Glücksspielautomaten anbieten.

References:

https://online-spielhallen.de/mr-bet-casino-aktionscode-ihr-schlussel-zu-exklusiven-vorteilen/

Upon arrival you may present your Crown Gifts card for payment.

From thoughtful design, bespoke furniture, and intuitive technology, experience Perth in pure luxury.

You will be prompted to provide a credit

card as guarantee, no charges will apply. If there isn’t a room available at your time of arrival you will still be able to register for your room and we will securely store your luggage for you.

Enjoy your time in the sunshine with a trip to the Crown Metropol Pool, featuring a

large main pool, a relaxation pool, and a family-friendly pool complete

with children’s waterslides. With uncompromising

attention to detail, friendly customer service and stylish hotel facilities,

Crown Metropol is the perfect choice for your next getaway.

A room dedicated to VIPs and premium gaming, the Pearl Room offers all

available games at the casino with a view of the Swan River, with private salons, service and parking.

A 15% surcharge applies on all Public Holidays (one

surcharge fee of 15% applies if Public Holiday falls on a Sunday).

A 10% surcharge applies on Sundays. Opening hours are subject to change.A 10%

surcharge applies on Sundays.

Construction is now underway on a bold new mix of dining and entertainment venues including a wine bar, beer garden, and premium international food hall.

Learn how setting a limit can add to a better gambling experience.

Register your details to be in the know for our

latest news and offers. Our in-house retailer offers a range of luxury Crown products available for purchase, including a select range of Crown linen and At Home products.

The reason is the recent arrest of a footballer in Paraguay for

a fake passport.

References:

https://blackcoin.co/viva-las-venice-a-complete-guide/

We tested 50+ games from all categories at each casino

and didn’t go below a balance of A$200 so that we could

request a payout. If you play at one of the sites featured on this page,

you can be certain that it is fair. While Australians are not allowed to run a casino themselves, it is perfectly

legal for them to gamble online. If the interface is a pain, the site is generally slow,

or worse, if the games themselves don’t run smoothly, you’ll hear it from us.

We’ve come across plenty of great casinos that are excellent in every way

except user experience. We focus on best payout casinos with higher %RTP to ensure you get the best possible returns.

Since the minimum withdrawal for cryptocurrency methods like Bitcoin and Ethereum is A$60, and they’re faster, I feel like the casino is discreetly pushing players toward using crypto instead. Similar to another online casino site from our list (hey there Neospin), Stay Casino is also gravitating a bit toward high rollers. This cashback offer comes with 5x wagering – a lesson other AU casinos can learn from. This is most likely the only time I’ve reviewed an online casino in Australia with a proper VIP welcome package.

References:

https://blackcoin.co/vip-betting-insights/

australian online casinos that accept paypal

References:

giaovienvietnam.vn

casino sites that accept paypal

References:

http://www.inzicontrols.net

Awesome post! Join the fun at https://www.eic-2whatsapp.com 在 WhatsApp 网页版上,您能够设定优先级来处理消息通知。 . Date: 2026-01-14 18:49:33 (-03).